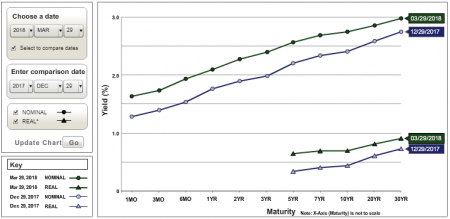

U.S. Treasury Yield Curve Nominal and Real Q1 2018 vs. Q4 2017

At the end of the 1st quarter of 2018, U.S. Treasury yields, on a nominal basis increased at all maturities from around 30 to 50 basis points. It was essentially the same situation on a real basis, with real rates up around 20 to near 40 basis points at all maturities.

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this, this, and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates. In summary, the interest rate environment is very important to commercial property investment.

View more yield curve quarterly snapshots.