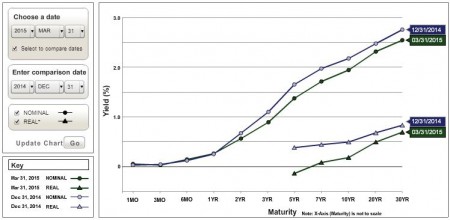

U.S. Treasury Yield Curve Nominal and Real Q1 2015 vs. Q4 2014

At the end of the 1st quarter of 2015, U.S. Treasury yields, on a nominal basis, were fairly unchanged in the shortest maturities, a touch higher in the 2-year maturity, and about 20 to 30 basis points higher for all maturities longer than 2 years. On a real basis, these yields dropped similarly, as the inflationary environment was relatively unchanged.

Interest rates affect commercial real estate in numerous ways (see this, this, and this). Borrowing costs are affected directly, with higher rates increasing borrowing costs and thus negatively affecting demand. Cap rates typically move with interest rates, albeit not in lockstep, with considered analyses generally seeming to conclude that cap rates on average move in the direction of 10-year rates, but only about a third as much. Interest rates affect the economy, which in turn affects vacancy and rents. In short, the interest rate environment is highly important to commercial real estate investment.

View more yield curve quarterly snapshots.