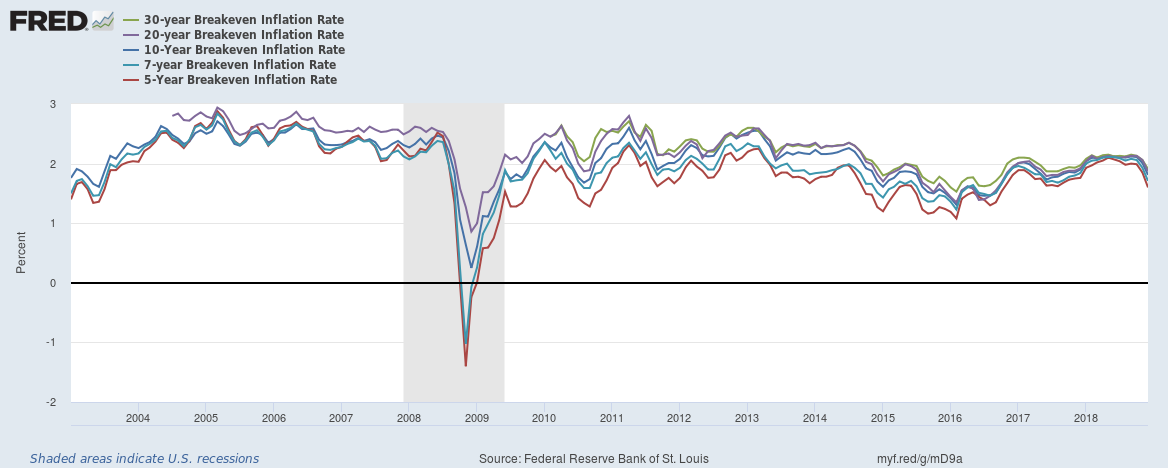

The difference in yield between that of Treasury Inflation Protection Securities, commonly referred to as TIPS, and the yield of ordinary U.S. Treasury securities with the same maturity dates is referred to as the TIPS spread. The chart above shows this spread for various maturites for the past 15 years.

Ordinary U.S. Treasury securities don’t initially take inflation into account, they instead are just bought and sold at some yield. Coupons and principal interest rates of TIPS, however, change based on the CPI (consumer price index). Thus, the spread between the two, the aforementioned TIPS spread, provides insight into the fixed income market’s expectations for inflation. This is also might be referred to as break-even inflation, the inflation rate at which investor in both will realize the same real (inflation adjusted) return. Stated more directly, the TIPS spread reflects forecasted inflation. The wider this spread is, the more it indicates investor anticipate higher inflation rates in the future. Adding credence to this is that it is not an indication of verbally stated opinions, but instead reflects opinions indicated by investment decisions made, a true case of those with opinions putting their money where their mouths are, Nothing beats market measures where participants have skin in the game.

The graph herein shows that these expected inflation rates spread out at times, particularly during a period of declining inflation expectations, with the shorter maturities seem to have the strongest reactions. This is just a matter of arithmetic. Consider that a 10-year expectation contains the 5-year expectation in that it is the first five years plus five more. Thus, as long as expectations average out over the long run, the shorter-term expectation, in this case the first five years, will be more variable that the longer-term expectation. An exception to this would happen if the market anticipates more normal inflation in the next five years, with less normal or abnormal inflation in the five years hence. That’s unlikely to happen, at least with regard to expectations. Of course, never say never, as they say.

It is worth noting that in the moment these declining expectations would also seem to reflect recent concerns for a slowing economy. Along with this, expectations for rate increases have subsided somewhat for the moment, as would generally be the case in the face of declining inflation expectations given that yields generally include some expectation of inflation to allow them for a yield after inflation. Expectations for inflation and for interest rates are both important to commercial real estate investors, making this TIPS chart, an updated version of which is accessible at the St. Louis Federal Reserve site, worthy of their ongoing attention.