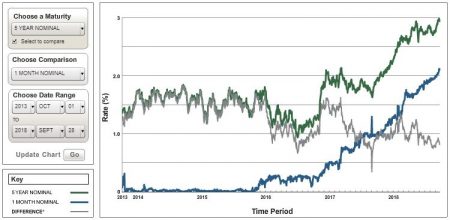

At the end of the 3rd quarter of 2018, both short and intermediate yields continued their climb begun nearly three years ago. As can be seen in the accompanying chart, five year rates, most closely tracked for commercial property borrowing cost, found themselves testing 3%, with short term (here 1 month) rates following close behind as they stayed at a spread similar to the one held in periods past as short terms rates hugged naught.

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this, this, and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates.