Over the years, I’ve found myself stunned whenever I looked at the drastically low appraisal value versus market value of certain properties with an agriculture use where the highest and best use is clearly something non-agricultural. Just recently, I ran across an article in The Atlantic that addressed this; America’s Dumbest Tax Loophole: The Florida Rent-a-Cow Scam. As one can tell by the title, the author isn’t favorable to the idea.

This got me thinking (always dangerous), wondering what exactly the cost of this might be. It struck me that one could quickly calculate this within our sunny county. One would only need to sum assessed value and market value as per the MDPA (Miami-Dade Property Appraiser) for ag use (agricultural use) properties, then do the same same for properties that are coded for agricultural use. With these numbers, one could calculate how much non-ag properties assessment ratio (assessed value to market value) would decrease if the assessment ratio was the same whether ag use or not.

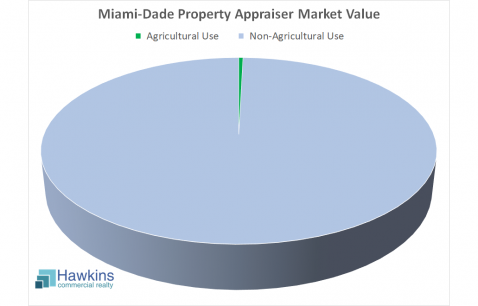

I thought the results would be supportive of The Atlantic author’s position, that property taxes could be considerably lower for most if this ag exemption didn’t exist. To my surprise I calculated the difference is de minimus, small potatoes, chump change, decimal dust. Though the assessment ratio for ag properties is indeed considerably lower than for non-ag, 49.3% versus 82.4%, the aggregate MDPA MV (market value) as a percentage of the MV of all ag property in the county is only 0.4%, thus the numbers don’t add up to much relative to the tax base. By my calculation, a $10,000 tax bill could drop by $13.53 per year, i.e. 0.1353%, if the assessed ratio on ag was the same. One might not leave it on the table at a restaurant, but given that there may be some societal benefits – I’ll leave that for others to debate – it is the kind of small thing that isn’t going to break the bank, far from it.

Check my math. Let me know if there’s an error in my logic. Here are the numbers:

Non-Ag Assessed: $339,464,318,324; Non-Ag MV: $411,928,383,816; Ag Assessed: $834,966,997; Ag MV: $1,692,175,009.