Investors often consider commercial property primarily on the cap rate (net operating income divided by price). In most cases there is the expectation of NOI (net operating income) growth and appreciation over time. These expectations are seemingly considered as benefits, with no consideration given to them as incremental return. In this post, we seek to quantify the effects.

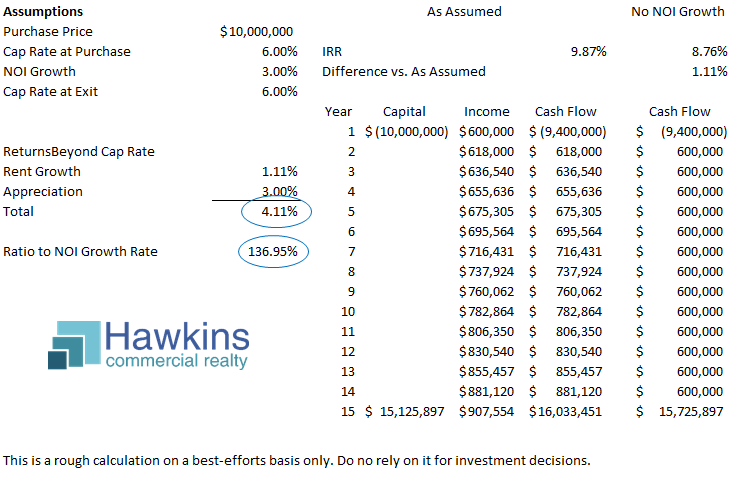

The example above is a fairly typical situation, a purchase at a 6% cap rate, with anticipated net operating income growth of 3% per year. In this situation, assuming a cap rate the same at sale as at purchase, and setting aside transaction costs for the moment, there would be an IRR on the capital equal to the NOI growth rate, in this example 3%.

There also is incremental return from the increases themselves, i.e. the incremental net operating income as it grows over time. To get at that, as a base return, I’ve calculated an IRR assuming cash flows given the NOI growth rate assumption and a sale 15 years later at the same cap rate. Then, I compare this to an IRR on the cash flows if the NOI never increased but the price increased in line with the NOI growth rate, in order words, with the benefits of the incremental annual NOI removed. This reduced the IRR by 1.11%.

Given this, I would submit that in this example, the IRR would increase by 3% for price movement plus 1.11% for NOI increases themselves, a total of 4.11%, as circled above, in incremental IRR. The ratio of this to the NOI growth assumption itself is is 1.37. If one increases or decreases the NOI growth assumption, this ratio moves, but not significantly. Thus, it seems reasonable to me to say that in typical commercial real estate investment scenarios, and assuming the same cap rate at sale as at purchase, IRR increases beyond the cap rate by an amount about 1.35 times the assumed NOI growth rate.

You may notice that the bulk of returns come from the income itself. This touches on a favorite subject of mine, the cost in terms of foregone income of holding vacant land. Undeveloped land has value based on what it could be earning. Fully developed land instead has value on what it is earning. Thus, by keeping the land vacant, an owner is forgoing income that the property’s value could be bringing in, income one could be earning if the property was sold and the proceeds were used to then purchase income generating property.

Astute readers will notice that the combined IRR of the effects beyond the cap rate at to 10.11% yet the IRR calculated as assumed arrives at 9.87%. This is a timing thing. In the interest of simplicity, this only calculated net annual cash flows. The objective of these calculations is in any case only to calculate a base IRR to then compare to the same with the effects of incremental NOI increases removed. What is of interest here is the difference. Indeed, this spreadsheet isn’t perfect, but I believe it is reasonably illustrative of the effects of NOI growth on returns in the form of IRR. If you find any errors in the calculations or logic, contact me.