Terra’s David Martin buys stake in Deauville Miami Beach site, plans reconstruction

Developer David Martin acquired a minority stake in the site of the former Deauville Beach Resort, a property that billionaire developer Stephen Ross had under contract two years ago. Deauville Associates, led by the Meruelo family, sold a 25 percent interest in the 3.8-acre oceanfront property at 6701 Collins Avenue in Miami Beach for $12.5 million. TMG 67 Communities LLC…

The Weekly Dirt: A brief history of the iconic Deauville

In the deal that was recorded this week, the Meruelo family retained majority ownership of the oceanfront property, once home to the historic resort that hosted the Beatles’ U.S. debut on “The Ed Sullivan Show” in 1964. For some perspective, let’s look back on the recent history of the iconic Melvin Grossman-designed hotel. Damage from a fire and Hurricane Irma in 2017…

Florida Rock pays $98M for quarry in Miami-Dade County

Florida Rock Industries bought a massive quarry outside of Miami-Dade County’s urban development boundary for $98.1 million. An affiliate of Jacksonville-based Florida Rock acquired a 590-acre mining site in an unincorporated area near Doral, records and Vizzda show. The deal breaks down to $166,271 per acre. The seller, an affiliate of Lutz, Florida-based Preferred…

Lights Now On At Five Park, Miami Beach’s New Tallest Building

The lights have now been turned on at South Beach’s new Five Park tower. The 48-story tower broke ground in 2021 at the entrance to South Beach. It is said to be taller than any other building in the city of Miami Beach, at 519 feet. When complete, it will include 280 luxury residential units, in a tower designed by Arquitectonica. Terra and GFO Investments…

One Of Wynwood’s Biggest Ever Apartment Buildings, AMLI Wynwood, Now Open

Get ready for hundreds more residents in Wynwood. AMLI Wynwood, a property with 316 luxury apartments, is now open, according to the AMLI Residential blog. Units are available now, the property website shows. A cross-block pedestrian passage is also now open, the blog post said. The project also includes 388 parking spaces, and is among the largest to break ground…

Okan Tower: Foundation Pour Photos & Estimated Completion Date Released

Contractors recently completed a foundation pour for the 70-story Okan Tower, which is set to reach a height of 902 feet in the air. It will be one of Miami’s tallest towers when it reaches completion, which is now planned for 2027, the developer said in a statement yesterday. Okan Tower is planned to include 163 residential units, 236 short-term rental residences managed by Hilton…

South Florida Office Rents Continue Torrid Rise Even As Leasing Slows

South Florida office rents continue to rise despite leasing activity failing to keep pace with last year across the region. Asking rates in Miami were up 9.1% year-over-year at the end of March, with tenants leasing 468K SF of office space in the first quarter, according to preliminary data from Cushman & Wakefield. Leasing activity was up 3.2% from the same period last year in Miami…

Miami’s Office Market Continues To Lead U.S.

Miami’s office market remained atop an index measuring foot traffic into office buildings last month. The Placer.ai index analyzes activity in major office buildings nationwide, and compares it to pre-COVID levels. Miami has enjoyed the fastest recovery of any city, the index shows. In March 2024, that growth continued. Office building activity in Miami was up 8% over the same month…

South Florida office market plateaus in first quarter

While South Florida’s office market is faring better than the rest of the nation, landlords are feeling the pinch from tenants with expiring leases looking to downsize space or leave, according to Colliers’ Jonathan Kingsley. “On a macro level in general, the office markets in the tri-county region are a bit challenged compared to prior quarters,” Kingsley told The Real Deal. “We have…

Una Residences Tops Off At 175 Northeast 25th Road In Brickell Area of Miami

Construction on Una Residences, Brickell’s first waterfront residential development in over a decade, has reached its full height, topping off at 47 stories. This 613-foot-tall building, designed by the internationally recognized architectural firm Adrian Smith + Gordon Gill (AS+GG) with Revuelta Architecture International as the architect of record, features 135 spacious…

Una Residences Tops Off At 47 Stories, Completion Early 2025

Miami’s Una Residences has topped off. The 47-story tower was planned to top off at 579 feet, making it one of the tallest in that part of Brickell. Construction for the project began in the fall of 2020, with contractors working to build the deepest and most expensive underground parking garage in Miami’s history. The 236-car garage reaches nearly 50 feet and three stories…

Plans Filed For 28-Story Mixed-Use Tower At 3055 Northeast 4th Avenue In Edgewater Area of Miami

Plans have been submitted for a 28-story mixed-use building at 3055 Northeast 4th Avenue in Edgewater, Miami. Referred to as Metro 2 at Edgewater (Metro 2) in the application, the project is designed by Burgos Lanza & Associates and developed by Metro Tower II LLC. The proposed building is set to rise 320 feet to the upper roof slab or 335 feet, including the highest…

Developer Driftwood Capital Announces Timeframe For ‘Transformative’ Riverside Wharf

An expected groundbreaking timeframe has been announced for downtown Miami’s Riverside Wharf project. Driftwood Capital, which is partnering with MV Real Estate Holdings and Merrimac Ventures, made the announcement. Groundbreaking for Riverside Wharf is now expected in the latter half of 2024. The $267m development is expected to be “transformative,” and will feature…

Palma Miami Beach Residences Announced for North Beach

Plans have just been announced for a new mixed-use condominium tower called Palma Miami Beach Residences in North Beach. It is the third of four planned residential towers in North Beach by New York-based Lefferts. Palma will rise 14 stories, with 126 condos planned. Units will be delivered fully finished and furnished, with short-term rentals permitted. Condo sizes range…

Mast Capital, AvalonBay Complete 254-Unit Avalon Merrick Park Apartment Community in Coral Gables

Mast Capital and Avalon Bay Communities have completed the development of Avalon Merrick Park, a 254-unit apartment community located at 3811 Shipping Ave. in the Coral Gables neighborhood of Miami. The property, which was constructed by general contractor First Florida, features studio, one-, two- and three-bedroom apartments, ranging from 456 to 1,530 square…

A ‘Come To Jesus’ Moment Looms For Owners Of South Florida’s Aging Condos

Changes to the laws governing condo associations and reserves have the potential to reshape the oceanfront skylines across South Florida, but a wide gulf between buyers and sellers is holding back that transformation. “It’s really going to take a come to Jesus time until they realize that there isn’t a pot of gold at the end of the rainbow,” Edgardo Defortuna, one of the region’s most…

Investcorp Acquires $200M South Florida and Denver Industrial Portfolio

Investcorp has acquired a 1.3 million-square-foot, 31-building industrial real estate portfolio in South Florida and Denver for about $200 million. Investcorp purchased Victory Commerce Center in suburban Cleveland in 2020. Image courtesy of JLL With this purchase, Investcorp has about 43 million square feet of U.S. industrial real estate assets, valued at about $5.1 billion.

Spaceport status OK’d for Homestead Air Reserve Base

Cape Canaveral is losing Florida’s corner on space exploration with the designation of Miami-Dade’s Homestead Air Force Base as an official spaceport. After both houses of the state legislature unanimously passed a bill in March expanding Florida’s spaceport territory to include Homestead Air Reserve Base, Gov. Ron DeSantis signed the bill into law this month. It takes effect July 1.

Location Ventures’ former Coral Gables dev site faces foreclosure

Another development site formerly owned by Rishi Kapoor and Coral Gables-based Location Ventures is the target of a foreclosure action. An entity managed by Chandler Halpern in Fort Lauderdale on Thursday sued Kapoor and the entity that owns the 1.6-acre property at 1505 Ponce de Leon Boulevard in Miami-Dade Circuit Court. The complaint alleges that Kapoor and the…

Robert Rivani’s Black Lion pays $63M for Miami Beach mixed-use building

Robert Rivani’s Black Lion hunted down its biggest purchase in South Florida to date, but will have to compete with other heavy hitter developers in Miami Beach’s office market. The Miami-based commercial real estate investment firm paid $62.5 million for a Miami Beach mixed-use building, The Real Deal has learned. Black Lion is paying at a 42 percent discount off the previous…

Investor Promises Luxury ‘Class-X’ Office After $62M Miami Beach Acquisition

Black Lion Investment Group, a real estate investment firm with offices in Miami and Los Angeles, isn’t just looking to upgrade the first office building it ever acquired — it has ambitions of creating an entirely new designation for property type: “Class-X.” The firm paid $62.5M for The Lincoln at 1691 Michigan Avenue in Miami Beach and announced plans for a $50M renovation…

Prime location drives Doral commercial realty boom

Doral’s prime location continues to drive the city’s high demand for commercial real estate. “The demand in Doral has been steady for years,” said Lee & Associates Senior Vice President Conner Milford. “I haven’t seen any sort of real drop, significant drop….” Doral is a premier location due to its proximity to PortMiami and Miami International Airport, Mr. Milford said.

MCR proposes pair of hotels on Hilton Miami Airport Blue Lagoon site

MCR wants to develop two hotels with 400 keys, combined, next to its Hilton-branded property near Miami International Airport. The hotel owner-operator proposes a pair of eight-story hotels, each with 200 units, adjacent to the Hilton Miami Airport Blue Lagoon at 5101 Blue Lagoon Drive in unincorporated Miami-Dade County, according to MCR’s application submitted…

Miami-Dade County is dealing with an affordable housing challenge: Through a combination of nationwide rising housing costs and a development pace struggling to keep up with the demand for rentals, the area finds itself in urgent need of new ways to bridge the gap. In fact, half of all households here spend more than 30% of their income on housing costs. While the situation… explore

Miami needs $5 billion to fight flooding

Miami’s new stormwater master plan prioritizes $600 million in near-term infrastructure improvements and anticipates over $5 billion will be needed to shore up the city against flooding and achieve long-term resiliency goals. After extensive research evaluating areas subject to extreme flooding, the City of Miami recently updated its stormwater master plan. The new…

New Miami mega-billboards put on 270-day hold

Miami is moving forward with a 270-day moratorium to halt all new applications for outdoor advertising signs as commissioners continue to debate details of a new ordinance. On April 11, the city commission considered two agenda items related to outdoor advertising downtown. The first, which would have repealed a January 2023 measure that updated the city’s outdoor…

Taurus proposes 159-unit workforce housing project in Goulds

Taurus Development proposes a 159-unit workforce housing project in Goulds, marking continuing investor interest in south Miami-Dade County. The Coral Gables-based firm wants to build a 15-story building on an acre of land at 11888 Southwest 220th Street in an unincorporated area of the county, according to a Taurus application submitted to Miami-Dade this month.

Miami Wilds developers countersue Miami-Dade over scuttled water park

The developers of Miami Wilds are accusing Miami-Dade County Mayor Daniela Levine Cava of killing a controversial water park deal to protect her reelection bid, a recent court filing states. Miami Wilds countersued Miami-Dade on Monday, alleging the county breached a 2022 lease agreement allowing the company to build the water park, a 200-room hotel and up to 20,000 sf…

Michael Lewis: Now-or-never pitch for county land for Costco is no bargain

You’ve heard it too often: a last-minute deal appears that the county must make now at giveaway prices or lose a great opportunity. You hear it when a car dealer or stockbroker or realtor tells you a price won’t last if you don’t buy today. The county heard it when owners said they’d move the Marlins to Las Vegas if the public didn’t build a $3 billion baseball stadium now. We also heard…

A Pre-Application for an ASPR review has been filed for a new multifamily development in Princeton, Miami-Dade County, leveraging the Live Local Act to foster community and accessibility. Set to occupy an entire 10.59-acre parcel at the northwest corner of Southwest 236th Street and Southwest 132nd Avenue, the project plans to feature multiple three-story buildings within…

Plans To Build 28-Story Edgewater Tower Filed With Miami Urban Development Review Board

Plans have just been filed with the Urban Development Review Board for Metro Edgewater 2, a 28-story tower. The new tower is planned next door to the first Metro Edgewater tower, which was completed last year with 279 apartments in a 32-story building. According to the new filing, Metro Edgewater 2 is planned to include: 103 multi-family dwelling units, ranging from 748 SF…

City Of Miami Files To Build Office Building Next To New Inter Miami Stadium

The City of Miami has filed plans for a new office building on a former public golf course where the Inter Miami soccer stadium is planned. The City of Miami Administrative Building is planned at 1822 NW 37 Ave. For now, only renderings have been filed, but the project is at least 200,000 square feet and therefore requires a hearing before the city’s Urban Development…

Camino Capital, partners propose 28-story mixed-use apartment tower in Edgewater

Four months after completing a 32-story apartment tower in Edgewater, a development team wants to build an adjacent 28-story mixed-use building with 103 rentals. Camino Capital Management, Lujeni and Building Block Realty propose Metro 2 at Edgewater on 0.7 vacant acres at 3055 Northeast Fourth Avenue in Miami, according to an application submitted to the city this month.

Anchor Health scores $58M construction loan for Baptist rehab center in South Miami

A health care real estate developer scored a $58.4 million construction loan for a Baptist Health rehabilitation center in South Miami. Charlottesville, Virginia-based Anchor Health Properties will develop a 92-bed facility on 2.4 vacant acres at 6201 and 6233 Sunset Drive, as well as at 7150 Southwest 62nd Avenue, according to South Miami records. First Citizens Bank & Trust…

Apple will open an office in Coral Gables, marking the continued expansion of tech companies in South Florida. The tech giant took 42,000 square feet at 2811 Ponce de Leon Boulevard, which is the North Tower at The Plaza Coral Gables mixed-use development, according to Cushman & Wakefield’s first quarter office report for Miami-Dade County. Bloomberg first…

Proposed 750-Foot Brickell Tower Submitted To FAA

Building heights for a proposed Brickell tower have been submitted to the Federal Aviation Administration. The filings were submitted to the agency on April 12. According to the filings, a building height of 737 feet above ground or 750 feet above sea level is proposed. The project site is the same as where a striking 65-story tentatively known as Calle 8 is currently moving through…

Photos: Topped Off 36-Story Modera Riverside In Downtown Miami

Photos show the topped off 36-story Modera Riverside tower in Downtown Miami. The building will include 428 apartments when it is complete. Developers have already filed plans to build a second tower at the complex, which is known as Nexus Riverside. That building will also be 36 stories and will have 345 apartments.

South Florida-Based Cymbal DLT Completes Construction of Laguna Gardens Apartments in Miami Gardens

Cymbal DLT Companies (Cymbal DLT) has completed construction on Laguna Gardens, a 341-unit garden-style multifamily community designed by the award-winning international design firm Jo Palma and Partners, located in the City of Miami Gardens. The development is now welcoming its first tenants after successfully issuing the initial Temporary Certificate of Occupancy (TCO).

Adam Neumann finally pulled back the curtain on his foray into multifamily investment Thursday, with the former WeWork CEO launching Flow at two apartment buildings in South Florida. The interview coincided with Flow launching a website with apartment listings for its properties in Miami and Fort Lauderdale, nearly two years after Neumann announced the brand…

WeWork’s Bankruptcy Finally Hits Miami

WeWork’s six Miami locations have so far avoided getting cut from the property roster as the coworking firm navigates Chapter 11 bankruptcy. That could be about to change. WeWork moved to reject its lease at 429 Lenox Ave. in Miami Beach in a Monday court filing. The coworking company is seeking a bankruptcy judge’s approval to exit the property at the end of May…

Developer Proposes 245-Unit Assisted Living Facility for 357 Racquet Club Road in Weston

SREH-357 Racquet Club LLC hopes to move forward with an assisted living facility in Weston, FL. Under the current proposal, the complex would comprise a six-story, 325,808-square-foot building, featuring 245 units and 303 beds. Of the 245 units, there would be 113 independent living units, 108 assisted living units, and 24 memory care units. On-site amenities would include…

A joint venture between Housing Trust Group (HTG) and Miami Lakes-based Elite Equity Development, Inc. (EED), has closed on financing and commenced construction on Naranja Grand II, a new $71 million affordable apartment community comprised of 200 residences in Homestead, Southwest Miami-Dade County. Naranja Grand II is the second phase of a…

Developer Proposes ‘Capri Place II’ with 180 Affordable Units for 8001 NW 27th Avenue in Miami

West Palm Beach-based Richman Group has plans for a 2.66-acre site in South Florida. New plans for Capri Place II call for 180 affordable housing units in a 12-story building. Our sources indicate that residences would span one-bedroom to two-bedroom floorplans. Communal amenities include a swimming pool, spa, and two-story, 206-spot parking garage. There would be…

Winmar Construction Begins Foundation Pour For The Avenue Coral Gables Hotel & Residences

Winmar Construction has initiated the foundation pour for The Avenue Hotel & Residences Coral Gables, a project developed by Roger Development Group. This Coral Gables-based, family-owned real estate development and management company is led by President & CEO Oscar Roger, Sr., alongside CFO Oscar Roger, Jr., who joined the company in 2013 and continues…

Naftali Group Breaks Ground On 67-Story JEM Private Residences At Miami Worldcenter

Naftali Group has officially broken ground on JEM Private Residences, a 67-story condominium development located at 1016 Northeast 2nd Avenue in Miami Worldcenter. Designed by the Miami-based architecture firm Arquitectonica and the New York City-based interior design firm Rockwell Group, the building will rise over 700 feet and feature 259 condo units on the upper levels…

New Renderings Of Viceroy Brickell As Sales Begin For 420 Condos

Viceroy Brickell has officially launched sales. The 45-story glass tower is already under construction, with completion projected in early 2026, the developers of the project said today. Viceroy Brickell – The Residences will form part of the One Brickell complex, where three towers are planned. Another tower, Baccarat Residences, is also under construction. The Viceroy Brickell…

Demolition Of Second Building At One Brickell City Centre as 97-Foot Office Tower Project Advances

It appears that demolition of a second building at the One Brickell City Centre site is moving forward Last month, the WSJ reported that Swire Properties and Related Companies were restructuring a deal to build a near-supertall office tower on the site. There are two existing office buildings on the site set for demolition. The first building, 700 Brickell Avenue, has an active demolition…

Overtown Zip Code Has The Most Untapped Development Potential, Report Says

Miami’s 33136 zip code, which includes part of Overtown and Park West, has the most untapped development potential for apartments in the county, according to a new analysis. Rentcafe analyzed Propertyshark data for the study, which looked at vacant land that could be developed into apartments. Miami has an urgent need to build more rentals as prices are expected to surge…

Photo: 2000 Biscayne Apartment Tower Nearing Completion

An apartment tower being built at 2000 Biscayne Boulevard is now nearly complete. The 36-story topped off nearly a year ago. It was planned to rise 408 feet above ground, according to a pre-construction filing. The pre-construction filings showed it would include 393 rental apartments, 455 parking spaces, and 4,569 square feet of retail. It forms part of a three-tower complex…

Carnival Puts Miami Headquarters Up For Sale As Doral Real Estate Soars

Carnival Corp. has listed for sale its sprawling headquarters on the outskirts of Miami, seeking to cash in on real estate the cruise giant has owned for roughly three decades. The company is now looking to downsize to about 300,000 square feet (27,871 square meters) of new office space in the Miami area, according to a person familiar with the matter…

Viceroy reborn: Related launches sales of branded Brickell condo tower

Related Group and its partner converted plans for an apartment tower under construction into a Viceroy-branded condo building along the Miami River. Coconut Grove-based Related and New York-based GTIS Partners launched sales of the 45-story, 420-unit Viceroy Brickell, The Residences, at 77 Southeast Fifth Street, just west of Brickell Avenue in Miami, according…

Calta launches sales of Coral Gables townhome project

Calta Group launched sales of Via Veneto, a planned Coral Gables luxury townhome development. The developer, led by Italian brothers Ignazio and Gaetano Caltagirone, tapped mother-son duo Judy and Nathan Zeder of the Jills Zeder Group at Coldwell Banker Realty to lead sales, according to a press release. Via Veneto will include 10 three-story townhomes, each spanning 5,500…

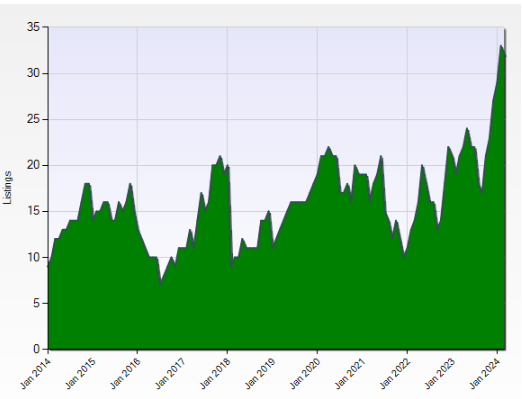

Chart: Miami-Dade Multifamily Listings Surge

Multifamily properties offered for sale generally go up on one or more listings platforms, one of which is the commercial MLS. It has seemed that there has been a rash of multifamily listings in recent weeks. Conveniently, the commercial MLS allows one to checks such a perception by viewing active listings counts over time, filtered for property type. In the chart above, we’ve…

Doral Central Park phases to open in summer

Since taking on the role as Doral interim city manager in February, Kathie Brooks’ top priority has been to ensure transparency throughout the city for its residents. The next big item on her agenda is targeting the opening of phases two and three of Doral Central Park by summer and completion by the end of the calendar year, Ms. Brooks told Miami Today. Ms. Brooks replaced…

Six Years In The Making, Portion Of Doral Central Park To Open In Summer

Whether you live or work in the city of Doral, you’ve noticed a massive construction site and took note when you started asking questions about when this project might be completed. South Florida residents could get to use at least a portion of Doral Central Park as soon as this summer, but we went to city for answers about the project. “When is it going to be opening…

Efstathios and Nicolas Tsatas acquire second Pompano Beach condo-hotel dev site

Canadian developers Efstathios Tsatas and Nicolas Tsatas are expanding their portfolio in Pompano Beach with plans for their second project, a condo-hotel. An entity managed by the pair acquired a nearly shovel-ready 1-acre site at 330 Southeast First Street, records and Vizzda show. The city of Pompano Beach approved a site plan and a building design development order several…

Maven pays $19M for LA Fitness building in Pompano Beach

Maven Real Estate picked up a standalone retail building leased to L.A. Fitness in Pompano Beach. An affiliate of Coral Gables-based Maven, led by Marc Schwarzberg, paid $18.8 million for the two-story gym at 1000 North Federal Highway, records and Vizzda show. The buyer obtained a $9.4 million mortgage from City National Bank of Florida. The deal breaks down to $330…

Regency Centers Sells Retail Asset Tamarac Town Square

Regency Centers has sold Tamarac Town Square, a 124,585-square-foot Publix-anchored shopping center in Tamarac, Fla., with the assistance of JLL. An affiliate of Jamestown purchased the 83.8 percent-leased asset for $22.5 million, as reported by The Real Deal. The property previously traded in 1998 for $10.2 million, according to CommerciaEdge data. Tamarac Town Square…

Jamestown pays $23M for Publix-anchored shopping center in Tamarac

Jamestown expanded its South Florida portfolio of shopping centers by paying $22.5 million for a Publix-anchored retail site in Tamarac. An affiliate of Atlanta-based Jamestown acquired Tamarac Town Square at 8129-8315 North Pine Island Road, records and Vizzda show. JLL represented the seller, an affiliate of Jacksonville-based Regency Centers. In 1998, Regency…

Moderno, 75Invest plan Live Local tower in Fort Lauderdale

Moderno Development Group and 75Invest Group filed plans for a Live Local Act mixed-income project in Fort Lauderdale. The developers submitted their application for 500 Art Lofts, a 27-story, 290-unit rental building planned for the site at 501 Southwest Second Avenue, south of the New River, said Doron Broman, founder of Miami-based Moderno. Seventy-one units…

Northbridge pays $18M for Deerfield Beach industrial complex

NorthBridge Partners acquired a three-building industrial complex in Deerfield Beach for $18.1 million. An affiliate of Wakefield, Massachusetts-based Northbridge bought Powerline Commerce Park at 1250 South Powerline Road, records and Vizzda show. The 4.5-acre site has 72,919 square feet of industrial space. The park was built in 1989. The deal breaks down to $248 psf.

Venture One Buys Boynton Logistics Center Industrial Park

Boynton Logistics Center features a total of 34 dock-high loading doors, 12 truck wells and four drive-in doors. Image courtesy of Cushman & Wakefield Venture One Real Estate has acquired Boynton Logistics Center, a 197,608-square-foot industrial campus in Boynton Beach, Fla., from Elion Partners. Cushman & Wakefield brokered the transaction. The brokerage firm…

Mutual of America Life Insurance hopes to get approval for a seven-story apartment complex on its Boca Campus. The unnamed building would comprise close to 345,000 square feet of new construction, offering 288 units. Layout plans would span one-bedroom to three-bedroom floorplans, averaging 844 square feet each. Of those units, 29 would be set aside as affordable…

Workforce Housing ‘Vista Gardens’ Approved for 12450 Central Boulevard in Palm Beach Gardens

Vista Gardens, a 221-unit apartment complex in Palm Beach Gardens, received approval from the City Commission April 4th. The four-story complex will offer homes ranging from one-bedroom to three-bedroom layout plans, with 10 percent (22 units) set aside as workforce housing. One of the biggest draws to the Mediterranean-style complex would be the two pickleball…

Vista Residential scores approval for 221-unit multifamily project in Palm Beach Gardens

Vista Residential Partners scored approval for a 221-unit apartment building with workforce housing in Palm Beach Gardens. Atlanta-based Vista Residential plans the four-story project, called Gardens Vista Apartments, at 12450 Central Boulevard, according to city records. The 16.7-acre vacant site is part of the larger Cimarron Cove master-planned development.

Amazon To Double Same-Day Delivery Hubs Nationally

Amazon is doubling down on the strategy it introduced last year to regionalize its retail distribution network—and run the whole logistics network with AI-driven inventory control—by rapidly expanding its same-day delivery capacity. The online retail giant is focused on speed—it can assemble and ship customer orders at same-day facilities in as little as 11 minutes—and increasing its…

The Conversation: Decoding the Trends in America’s Commercial Real Estate Market In the dynamic world of commercial real estate, understanding the broader perspectives and global trends can offer valuable insights into local markets. Recently, a conversation unfolded on America’s Commercial Real Estate Show, shedding light on the international investor view of commercial…

The Historic Tax Credit program, explained

Historic buildings are part of what make neighborhoods unique, and preserving these buildings can spur economic activity as developers create jobs to revitalize aging properties. Through the Historic Tax Credit (HTC) program, federal tax law provides an income tax credit to developers, who own historic buildings that undergo substantial rehabilitations into income-producing uses…

Urban Core Multifamily No Longer Grossly Underperforming Suburban Counterparts Nationally

In a typical, pre-pandemic world, urban core submarkets generally underperformed their suburban counterparts by a small margin. Urban core occupancy typically fell less than 100 basis points (bps) below suburban occupancy. Likewise, annual effective rent change in urban cores underperformed suburban counterparts by about as much. Then came the pandemic. Arguably no…

The Fed: Beige Book Shows Modest Growth, Continued Easing of Price Pressures

Economic activity in the Southeast grew modestly over the past several weeks as labor market and pricing conditions broadly continued on their paths of recent months, according to the new Beige Book anecdotal report from the Federal Reserve Bank of Atlanta. Most Atlanta Fed contacts said it continued to get easier to fill open jobs. Even so, business leaders across…

Apples and oranges: Florida passes a slew of pro-development laws, contrary to New York

As the New York State Legislature struggles to pass the state’s budget, divided, in part, over how to handle key housing policies, the Florida Legislature has gone in the opposite direction. Last month, Florida lawmakers wrapped up the 2024 session with the approval of a $117.5 billion state budget and the passage of a handful of pro-development bills. In the last two years, lawmakers…

‘No Rest For The Weary’: What Higher Interest Rate Expectations Mean For CRE

The first half of this year was supposed to be when interest rates began coming down, providing a lifeline to struggling commercial real estate owners. But it now appears the Federal Reserve may not be coming to the rescue anytime soon. Following Wednesday’s consumer price index report showing that inflation rose 3.5% year-over-year in March, the expert consensus around…