Mitch Roschelle, Real Estate Practice Leader at PwC, and Andrew Warren, Director of Real Estate Research at PwC, make an appearance on America’s Commercial Real Estate Show to discuss the PwC / ULI 2018 Emerging Trends report. Among the trends discussed in this video are: what is Emerging Trends; how results are formulated; business profitability expectations; measure of sentiment; economic expansion; cycle expectations; sector outlook; stock; investments.

Video: PwC’s Mitch Roschelle, Andrew Warren on PwC/ULI Emerging Trends in Real Estate: Part 1

Video: Yardi Matrix BI Director Doug Ressler Presents Office Investment Trends and Forecasts

Doug Ressler, Director of Business Intelligence at Yardi-Matrix, an apartment information service provider, appears on The Commercial Real Estate Show to discuss trends and forecasts in the office property market. Among the topics covered are occupancy and rental rates for the office market, profitability, and some tips going forward for investing in office building properties.

Video: Walking & Talking at the IREM 2017 Global Summit

America’s Commercial Real Estate Show host Michael Bull joins the Institute of Real Estate Management’s Global Summit 2017 in Chicago to bring you the IREM experience. Various speakers and key players at IREM are interviewed to get their take on IREM and the real estate industry.

Video: Developers Andrew Frey, Kobi Karp, Jesse Ottley, and Santiago Vanessa on Next Generation Development & Design

Alfonso Jaramillo talks with developers Andrew Frey of Tecela, Kobi Karp, Jesse Ottley, and Santiago Vanessa about future development in the city of Miami and Abroad.

Video: Miami Investor Roundtable ~ Where is the Value?

Jose Maria Serrano, President of Commercial, talks with Carlos Andres Chavarro, William Fuller, and Bernado Rieber about the best practices for commercial real estate developers.

Video: NAR Economist George Ratiu on the Economy and Global Investment

George Ratiu, economist at NAR, discusses the climate of commercial real estate around the world.

Video: Berger Singerman’s Andrew Hinkes on Block Chain, Bitcoin, Future Currency, and Implications for Commercial Real Estate

Andrew Hinkes, a lawyer with Berger Singerman talks about the applications of bitcoin in commercial real estate.

Video: Miami Work Force Housing Forum ~ The Next Phase

2018 Realtors® Commercial Alliance President Elect Jennifer Wollmann talks affordable housing with Kahunah Group Properties CEO Matis Cohen, Department of Planning and Zoning Principal Planner Rosa Davis, Uribe Construction Senior Vice President Jeff Feldman, and Deep Blocks CEO Olivia Ramos.

Latitude One Office Condo Buyer’s Broker Expertise

With recent efforts to secure an office condo for a customer, we came to understand the process from a buyer’s and tenant’s perspective. We contacted every unit in the building directly or indirectly, in the process identifying every unit that is listed or otherwise available, i.e. publicly or privately offered, for sale or lease. If you are interested in buying or leasing an office condo, we can be of significant assistance. We’ve developed an advanced feel for pricing, where deals can be had, and who is selling. As this post is being published, we are aware of numbers of units available for sale and numbers available for lease. Working with you as your buyer’s broker, I’m working with you, beside you, on your team, not on behalf of any particular listing. I’ll help you get the best deal, the right deal, right now.

This is not a listing. This is instead a suggestion to work with us as your (buyer’s) broker to help you search for office condominiums in Latitude One in the Downtown Miami. Working with a buyer’s broker is a common practice. In this case, working with us brings not only benefits typically afforded by working with a buyer’s broker, but it also offers the benefit of working with someone that has negotiated both to purchase and lease multiple properties within office condo buildings.

Contact us now:

James Hawkins

786-581-7990

james@hawkinscre.com

The existing units in this building according to Miami-Dade records retrieved in 2017 are: 175 SW 7 Street Unit 1100; 175 SW 7 Street Unit 1101; 175 SW 7 Street Unit 1102; 175 SW 7 Street Unit 1103; 175 SW 7 Street Unit 1104; 175 SW 7 Street Unit 1105; 175 SW 7 Street Unit 1106; 175 SW 7 Street Unit 1107; 175 SW 7 Street Unit 1108; 175 SW 7 Street Unit 1109; 175 SW 7 Street Unit 1110; 175 SW 7 Street Unit 1111; 175 SW 7 Street Unit 1112; 175 SW 7 Street Unit 1200; 175 SW 7 Street Unit 1201; 175 SW 7 Street Unit 1202; 175 SW 7 Street Unit 1203; 175 SW 7 Street Unit 1204; 175 SW 7 Street Unit 1205; 175 SW 7 Street Unit 1206; 175 SW 7 Street Unit 1207; 175 SW 7 Street Unit 1208; 175 SW 7 Street Unit 1209; 175 SW 7 Street Unit 1210; 175 SW 7 Street Unit 1211; 175 SW 7 Street Unit 1212; 175 SW 7 Street Unit 1214; 175 SW 7 Street Unit 1215; 175 SW 7 Street Unit 1216; 175 SW 7 Street Unit 1217; 175 SW 7 Street Unit 1218; 175 SW 7 Street Unit 1400; 175 SW 7 Street Unit 1401; 175 SW 7 Street Unit 1402; 175 SW 7 Street Unit 1403; 175 SW 7 Street Unit 1404; 175 SW 7 ST; 175 SW 7 Street Unit 1405; 175 SW 7 Street Unit 1406; 175 SW 7 Street Unit 1407; 175 SW 7 Street Unit 1408; 175 SW 7 Street Unit 1409; 175 SW 7 Street Unit 1410; 175 SW 7 Street Unit 1411; 175 SW 7 Street Unit 1412; 175 SW 7 Street Unit 1414; 175 SW 7 Street Unit 1415; 175 SW 7 Street Unit 1501; 175 SW 7 Street Unit 1502; 175 SW 7 Street Unit 1503; 175 SW 7 Street Unit 1504; 175 SW 7 Street Unit 1505; 175 SW 7 Street Unit 1506; 175 SW 7 Street Unit 1507; 175 SW 7 Street Unit 1508; 175 SW 7 Street Unit 1509; 175 SW 7 Street Unit 1510; 175 SW 7 Street Unit 1511; 175 SW 7 Street Unit 1512; 175 SW 7 Street Unit 1514; 175 SW 7 Street Unit 1515; 175 SW 7 Street Unit 1516; 175 SW 7 Street Unit 1517; 175 SW 7 Street Unit 1518; 175 SW 7 Street Unit 1519; 175 SW 7 Street Unit 1520; 175 SW 7 Street Unit 1521; 175 SW 7 Street Unit 1522; 175 SW 7 Street Unit 1523; 175 SW 7 Street Unit 1524; 175 SW 7 Street Unit 1525; 175 SW 7 Street Unit 1600; 175 SW 7 Street Unit 1601; 175 SW 7 Street Unit 1602; 175 SW 7 Street Unit 1603; 175 SW 7 Street Unit 1604; 175 SW 7 Street Unit 1605; 175 SW 7 Street Unit 1606; 175 SW 7 Street Unit 1607; 175 SW 7 Street Unit 1608; 175 SW 7 Street Unit 1609; 175 SW 7 Street Unit 1610; 175 SW 7 Street Unit 1611; 175 SW 7 Street Unit 1612; 175 SW 7 Street Unit 1614; 175 SW 7 Street Unit 1615; 175 SW 7 Street Unit 1616; 175 SW 7 Street Unit 1617; 175 SW 7 Street Unit 1618; 175 SW 7 Street Unit 1701; 175 SW 7 Street Unit 1702; 175 SW 7 Street Unit 1703; 175 SW 7 Street Unit 1704; 175 SW 7 Street Unit 1705; 175 SW 7 Street Unit 1706; 175 SW 7 Street Unit 1707; 175 SW 7 Street Unit 1708; 175 SW 7 Street Unit 1709; 175 SW 7 Street Unit 1710; 175 SW 7 Street Unit 1711; 175 SW 7 Street Unit 1712; 175 SW 7 Street Unit 1714; 175 SW 7 Street Unit 1715; 175 SW 7 Street Unit 1716; 175 SW 7 Street Unit 1717; 175 SW 7 Street Unit 1718; 175 SW 7 Street Unit 1800; 175 SW 7 Street Unit 1801; 175 SW 7 Street Unit 1802; 175 SW 7 Street Unit 1803; 175 SW 7 Street Unit 1804; 175 SW 7 Street Unit 1805; 175 SW 7 Street Unit 1806; 175 SW 7 Street Unit 1807; 175 SW 7 Street Unit 1808; 175 SW 7 Street Unit 1809; 175 SW 7 Street Unit 1810; 175 SW 7 Street Unit 1811; 175 SW 7 Street Unit 1812; 175 SW 7 Street Unit 1814; 175 SW 7 Street Unit 1815; 175 SW 7 Street Unit 1816; 175 SW 7 Street Unit 1817; 175 SW 7 Street Unit 1818; 175 SW 7 Street Unit 1900; 175 SW 7 Street Unit 1901; 175 SW 7 Street Unit 1902; 175 SW 7 Street Unit 1903; 175 SW 7 Street Unit 1905; 175 SW 7 Street Unit 1906; 175 SW 7 Street Unit 1907; 175 SW 7 Street Unit 1908; 175 SW 7 Street Unit 1909; 175 SW 7 Street Unit 1910; 175 SW 7 Street Unit 1911; 175 SW 7 Street Unit 1912; 175 SW 7 Street Unit 1914; 175 SW 7 Street Unit 1915; 175 SW 7 Street Unit 1916; 175 SW 7 Street Unit 1917; 175 SW 7 Street Unit 1918; 175 SW 7 Street Unit 2000; 175 SW 7 Street Unit 2001; 175 SW 7 Street Unit 2002; 175 SW 7 Street Unit 2003; 175 SW 7 Street Unit 2004; 175 SW 7 Street Unit 2005; 175 SW 7 Street Unit 2006; 175 SW 7 Street Unit 2007; 175 SW 7 Street Unit 2008; 175 SW 7 Street Unit 2009; 175 SW 7 Street Unit 2010; 175 SW 7 Street Unit 2011; 175 SW 7 Street Unit 2101; 175 SW 7 Street Unit 2102; 175 SW 7 Street Unit 2103; 175 SW 7 Street Unit 2104; 175 SW 7 Street Unit 2105; 175 SW 7 Street Unit 2106; 175 SW 7 Street Unit 2107; 175 SW 7 Street Unit 2108; 175 SW 7 Street Unit 2109; 175 SW 7 Street Unit 2110; 175 SW 7 Street Unit 2111; 175 SW 7 Street Unit 2112; 175 SW 7 Street Unit 2114; 175 SW 7 Street Unit 2115; 175 SW 7 Street Unit 2116; 175 SW 7 Street Unit 2117; 175 SW 7 Street Unit 2118; 175 SW 7 Street Unit 2201; 175 SW 7 Street Unit 2202; 175 SW 7 Street Unit 2203; 175 SW 7 Street Unit 2204; 175 SW 7 Street Unit 2205; 175 SW 7 Street Unit 2206; 175 SW 7 Street Unit 2207; 175 SW 7 Street Unit 2208; 175 SW 7 Street Unit 2209; 175 SW 7 Street Unit 2210; 175 SW 7 Street Unit 2211; 175 SW 7 Street Unit 2212; 175 SW 7 Street Unit 2214; 175 SW 7 Street Unit 2215; 175 SW 7 Street Unit 2216; 175 SW 7 Street Unit 2217; 175 SW 7 Street Unit 2218; 175 SW 7 Street Unit 2301; 175 SW 7 Street Unit 2302; 175 SW 7 Street Unit 2303; 175 SW 7 Street Unit 2304; 175 SW 7 Street Unit 2305; 175 SW 7 Street Unit 2306; 175 SW 7 Street Unit 2307; 175 SW 7 Street Unit 2308; 175 SW 7 Street Unit 2309; 175 SW 7 Street Unit 2310; 175 SW 7 Street Unit 2311; 175 SW 7 Street Unit 2312; 175 SW 7 Street Unit 2314; 175 SW 7 Street Unit 2315; 175 SW 7 Street Unit 2316; 175 SW 7 Street Unit 2317; 175 SW 7 Street Unit 2318; 175 SW 7 Street Unit 2401; 175 SW 7 Street Unit 2402; 175 SW 7 Street Unit 2403; 175 SW 7 Street Unit 2404; 175 SW 7 Street Unit 2405; 175 SW 7 Street Unit 2406; 175 SW 7 Street Unit 2407; 175 SW 7 Street Unit 2408; 175 SW 7 Street Unit 2409; 175 SW 7 Street Unit 2410; 175 SW 7 Street Unit 2411; 175 SW 7 Street Unit 2412; 175 SW 7 Street Unit 2414; 175 SW 7 Street Unit 2415; 175 SW 7 Street Unit 2416; 175 SW 7 Street Unit 2417; 175 SW 7 Street Unit 2418. These units appear to be or have been owned by a number of individuals and entities including: Gold Coast Fd LLC; Gold Coast Fund LLC; Latitude Invest 1102 & 1103 LLC; Mercedes Roldan Chesa; US Brokers LC; Adasol Inc; 1108 Latitude Inc; Highland Real Estate V LLC; Netnmarket Inc; Kaluz Investments LLC; Viajes El Corte Ingles Inc; C/O Berenthal & Associates; Viajes El Corte Ingles Inc; F A Condos Dade 2 LLC; Coral Key Investments Ii LLC; Sunrise Properties Intl Corp; Latitud 0809 LLC; Canyon King Properties LLC; 175 Sw 7Th St #1211; Miami Fl 33130 LLC; On The River LLC; Buena Vista Brickell Inc; Ofilat Holdings LLC; Calle 58 No 7-80; Unicorn Investments LLC; Latitude 1400 Inc; Maclatitude LLC; Grac Investment Inc; Miami Riverfront Parcel; Mtrll LLC; Monvel Investments LLC; De Roode Orthodontics Pa; Lg Property Investments LLC; Duque Rengife Inversiones Miami; LLC; Miracle Mile Assets Inc; Latre Holdings LLC; 175 Sw 7Th St No 1503 LLC; Bpk Investments LLC; Redavi LLC; Isf Investment LLC; Hotel Emperador Av Miranda Sect; Italo Inversiones 2012 LLC; Latitude One 1508 Corp; Karen Fish Will; Latitude 1510 LLC; Premier Global Financial; Services LLC; Biscayne Capital Grp LLC; Everest Intl Tech & Education; Development Inc; Gables Square 700 LLC; Teca Group Usa Inc; Gb & Sy Investments Inc; Latitud River LLC; 1520 Latitude One LLC; Digital Media Solutions Inc; Rivera Arellano LLC; Quindio LLC; Ingenious LLC; Latitude One 1601 LLC; Sara Lopez; Cadi Holdings LLC; Desarrollos Corzal Miami Inc; Ghama Investments LLC; Homaga Investment LLC; Alexme Inc; Lake Plaza Intl Inc; Prime Star Real Estate LLC; Corner Trading LLC; Lat 1615 LLC; Cae Computer Aided Usa Corp; Alonso Caetano Americas Inc; Invific Corp; Latitude One Partners LLC; Alfamerica Ii Corporation; Latitude 17 LLC; Latitude 1706 LLC; Rosat2810 Corp; Osm LLC; Riverfront Miami Condos LLC; Latitude 1711 LLC; Grupo Corcan Ave 107; Latitude 1712 LLC; Groupo Corican Ave 107; Cataife Consulting Group LLC; Dragon Fly 2015 LLC; Manga Investments Inc; Valu LLC; Productos Alimenticios; El Galpon LLC; Faius Capital Corp; Inaki Saizarbitoria &; Olga Saizarbitoria; Mvdm Holdings LLC; Nobara LLC; Chaparral Holdings LLC; Ba Design Group Inc; Merco South Corp; MNA And SSB LLC; Jorge Losada &W Tania S Jtrs; Latitude Real Estate LLC; Latitude Y LLC; Latinamerican Television Latv LLC; Espiga Real Est Investments LLC; Latitud Office LLC; Latitude Business LLC; Santi Espiritus Immobilia LLC; Millennium Platinum Realty Inc; Flus LLC; Jbml Holdings LLC; Ruran Capital LLC; Hyabusa LLC; Lo 1911 LLC; Seagulls LLC; Sage Developers LLC; MLB Properties LLC; Happy Smiles LLC; Jurel Usa LLC; MCB Associates Inc; Latitude One 2004 LLC; Inmoven Enterprises Inc; Pivet Usa LLC; Security Re Corp; Morgan Lloyd Co; Venture Brothers LLC; Latitude 21 LLC; Dmc Latitude LLC; Blue Gardens Investments Corp; Bankers Intl Rlty Corp; Blue Key 22 LLC; Pacaembu Realty LLC; Latitude 2208 LLC; Latitude 2208 LLC; SJB Properties LLC; C/O Parrondo & Associates Pa; SJE Properties LLC; Lat23 Partners LLC; Torrealba & Co LLC; Esqiba LLC; RRT Productions LLC; C/O William H Albornoz; Assist Card Of Florida Inc; Cityview LLC; Aphesis Holdings LLC; American Nvo Corp; Inverproyectos LLC; Mario Borda; Por El Rio Inc; Caiazza Inc.

This is not a listing. This is instead a suggestion to work with us as your (buyer’s) broker to help you search for office condominimums in Latitude One in the downtown area of Miami within the greater Miami metro area of Miami-Dade County in Florida.

Video: ICSC VP Stephanie Cegielski Provides Holiday Shopping Forecast

Stephanie Cegielski, V.P of Public Relations at ICSC, joins host The Commercial Real Estate Show to talk about retail property cap rate trends, rising interest rates potentially affecting cap rates, and future forecasts impacting the retail property market. Highlights include:

- Forecasting 3.8% year over year growth in holiday sales this season across all mediums, i.e. both online and brick and mortar

- 96% of Consumers will make use of brick and mortar retail during season

- Consumers are confident and comfortable this year, more than last

- Apparel, toys, electronics are most in demand

Interestingly, when asked about brick and mortar retail sales, instead of making a projection, she – politician style – answered a different question about what percentage of consumers will shop at brick and mortar stores. Thus, the most pressing question about retail, and thus retail properties, she seemingly avoided, noticeably so. Hmm. I wonder why this might be. I wonder…

Video: Real Page’s Jay Parsons on Multifamily Properties

Jay Parsons, Director of Analytics at Real Page, Inc., joins The Commercial Real Estate Show to talk about the multifamily property market occupancy, rental rates, rent cuts in target markets, forecasts and demands.

Yield Curve Quarterly Snapshot – 2017 Q3

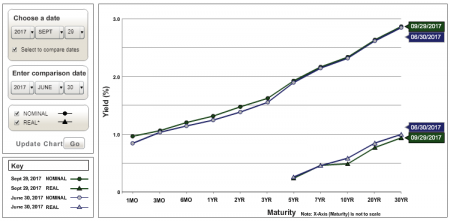

U.S. Treasury Yield Curve Nominal and Real Q3 2017 vs. Q2 2017

At the end of the 3rd quarter of 2017, U.S. Treasury yields, on a nominal and real basis, were largely unchanged at all maturities. At every maturity, the basis point movement appears to be under 10 basis points at all maturities, both on a real and nominal basis.

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this, this, and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates. In summary, the interest rate environment is very important to commercial property investment.

View more yield curve quarterly snapshots.

Video: Barbara Denham, Economist at Reis, Submits Office Property Investment Forecast

Barbara Denham, Economist at Reis, appears on this episode of The Commercial Real Estate Show to talk about office market cap rate trends, rising interest rates effecting cap rates, and future forecasts impacting office space.