Aventura Office Tower Tops Out

Developer Inmobiliaria Brom has topped out Optima Onyx Tower, a Class A, 308,198-square-foot office high-rise in Aventura, Fla. General contractor NV2A Group broke ground on the project in 2017 and is on schedule for completion in the second quarter of 2020. The Onyx Tower is part of the Optima office campus, the developer’s first project outside of Mexico City. Located at 21500 Biscayne Blvd in an…

Video: HUD Secretary Ben Carson Discusses Opportunity Zones and the Future of Housing

The current HUD Secretary Ben Carson shares thoughts about the future of housing and the role of the real estate industry, followed by questions and answers. He spends considerable time discussing Opportunity Zones, starting off by highlighting a visit at the Omni Community Redevelopment Agency district “where developers are building more than 250 rental housing units with about 30,000…

300 Affordable Units Coming Along FEC Rail Corridor

The South Florida Housing Link Collaborative, a coalition of five nonprofit groups, announced a $5M investment Wednesday from JPMorgan Chase, which will be used to develop affordable, resilient housing along the Florida East Coast Railway line in Miami-Dade, Broward and Palm Beach counties. Miami Mayor Francis Suarez, Florida Lt. Gov. Jeannette Nunez and former U.S. Sen. Mel Martinez…

Move could unlock redevelopment of Miami River marina

Miami has moved to downzone more than nine acres by the Miami River, a change that would reflect a lawsuit that saw a city-approved land-use change overruled. The city’s application received a 6-1 recommendation for approval from the city’s Planning, Zoning and Appeals Board as the rezone makes its way to the city commission. The current zoning of the property at 1583 NW 24th Avenue, site of…

Office projects and tenants migrate to Wynwood

Not once in its entire history, first as an industrial area and then as an edgy mecca for art, food, and entertainment, has Wynwood had purpose-built office space. Until now. No fewer than four properties incorporating office space have been delivered within the year or are under construction. Late last year, Goldman Properties debuted its Wynwood Garage, which features 30,000 square feet of offices along…

NFL kicks ahead funding for lighting Baywalk

Directors of Miami’s Downtown Development Authority voted unanimously to allocate $643,371 to install LED lighting in portions of Bayfront and Maurice A. Ferre parks, but $600,000 of that money will come from the National Football League and the City of Miami. And, in hopes of having the project completed before Super Bowl LIV festivities kick off at the end of January, they voted to waive…

Wynwood streetscape plan nears finish line

As Wynwood swells with visitors as the neighborhood becomes increasingly more popular, a plan for Wynwood’s streets is expected to be finished in the coming months. A streetscape master plan for the City of Miami’s art district is currently in the works and could be approved and codified into the Wynwood Neighborhood Revitalization District plan as soon as March, according to Albert Garcia, the…

Panattoni drops $24M to build new industrial project near Opa-locka

Panattoni Development Company’s Carl Panattoni, Gratigny Logistics Park Panattoni Development Company paid $24.3 million for the 20-acre site of a dairy farm and plans to build a speculative warehouse project. The new industrial development at 3000 Northwest 123rd Street near Opa-locka will be known as Gratigny Logistics Park. It sold for $1.2 million per acre, according to a press release. ZSF/WD…

The latest celebrities to invest in real estate include A-Rod, Dumervil, Beckham in Miami

Celebrities from Jennifer Aniston to Sting to Oprah Winfrey regularly make headlines when they buy or sell lavish homes, but a handful of actors, athletes and public figures have taken their real estate investing to the next level. Retired all-star Yankee Alex Rodriguez — who was featured on The Real Deal’s cover last month — is a case in point. His firm, A-Rod Corp., has purchased more than 15,000…

Video: Don Peebles Opines on the Miami Real Estate Market

Don Peebles, a South Florida-based developer with projects across the country as the founder, Chairman, and CEO of Peebles Corporation, took a moment at a recent Miami real estate conference and showcase to speak about the Miami real estate market. Some key insights from his comments include: “I think the market in Miami’s always an ebb and flow it’s a volatile market which is good for developers…

Notable Retail Leases Signed in South Florida Q3 2019

South Florida Retail Leases 2019 We’ve compiled a comprehensive list of the top retail leases signed by square footage in South Florida during Q3 2019. This quarter was very busy overall and saw several big box leases signed and sealed. Despite the sentiment that the traditional retail market is suffering due to several factors, particularly…

California investor searching for higher yield buys South Miami, Coral Gables medical office building portfolio

A San Diego-based investor acquired two medical office buildings in South Miami and Coral Gables, in what a broker on the deal called an example of the rise in out-of-state buyers searching for higher yield in Florida. ShareMD, a real estate investment company led by George Scopetta, paid $33.15 million for the 50,000-square-foot buildings at 5966 South Dixie Highway and 475 Biltmore…

ShareMD Acquires Two Medical Office Buildings Near Miami for $33.2M

ShareMD has acquired a medical office building in South Miami and one in Coral Gables for $33.2 million. Located at 5966 S Dixie Highway in South Miami, the first medical office building sold for $19.6 million. The facility spans 50,600 square feet and was 71 percent leased at the time of sale. The other property, The Biltmore Professional Building, is located at 475 Biltmore Way in Coral Gables and…

Miami Medical Office Buildings Trade for $33M

Real estate investment firm ShareMD has acquired two medical office buildings in South Miami and Coral Gables, Fla., for a total of $33.2 million. Miami investor Leonard Boord, founder of Slon Capital, sold both properties. The Easton Group represented the buyer in the deal, with Vice President Elliott LaBreche identifying both properties and negotiating prices. The South Miami asset, SoMi Building, is located…

MMG Equity Partners picks up retail center in Cutler Bay

Who says retail is dead? MMG Equity Partners paid $16 million for a shopping center in Cutler Bay. MMG Equity Partners purchased the 127,072-square-foot Centre at Cutler Bay, at 18901 Southwest 106th Avenue, for $126 per square foot, records show. Cutler Center Holdings, LLC, which is tied to Luis Boschetti, sold the property. The retail center was built in 2008. Cutler Center Holdings, LLC bought…

$16M Sale of Mixed-Use Property in Metro Miami Negotiated

Avison Young has negotiated the $16 million sale of Centre at Cutler Bay, a 127,072-square-foot office and retail property in Cutler Bay. The fully occupied asset is situated at 18901 SW 106th Ave., 20 miles southwest of downtown Miami. The Centre at Cutler Bay’s tenant base consists of child and adult daycare centers, a career counseling center and offices for accountants, insurance agents and real estate…

Allegations of shoddy construction pile up at Related’s One Ocean

One Ocean Allegations of shoddy construction at a Related Group development in South Beach, where its chairman and CEO Jorge Pérez is trying to sell his penthouse, are piling up. A recent lawsuit filed in Miami-Dade Circuit Court accuses Related, architects Sieger Suarez, general contractor Plaza Construction of Florida and three subcontractors of failing to address numerous construction defects inside…

Developers, ex-mayor push for rail expansion in Wynwood, Little Haiti and Liberty City

A handful of landowners in Miami want the next Tri-Rail station to be built on their properties, including sites near Midtown Miami, the Magic City Innovation District in Little Haiti, and Liberty City in northwest Miami-Dade County. At two public meetings last week, officials discussed new stations for Tri-Rail, a publicly funded commuter train that has operated along the state-owned…

Duty Free Americas owner will have to pay taxes on this sale

The party keeps going for Hialeah’s red hot industrial market. Wheelock Street Capital, in a partnership Mitchell Property Realty, paid $26.8 million for a 234,146-square-foot fully-leased warehouse at 1000 Southeast 8th Street in Hialeah. The price breaks down to $114 per square foot. The warehouse is close to the Miami International Airport and is fully leased by Tuuci, a high-end manufacturer of shade…

WeWork’s woes spark worry

The fallout from coworking trailblazer WeWork’s IPO wipeout and management kerfuffle is sending a wave of worry across the office landscape. WeWork dropped a proverbial bomb on landlords across its 23 million- square-foot portfolio of urbane, barista-brewing, shared-office and coworking spaces with its late summer S-1 prospectus, showing that the trend-setting startup was gushing red ink.

Pinstripes bowling alley inks lease at The Plaza Coral Gables

Pinstripes signed a lease at The Plaza Coral Gables, a major mixed-use project under construction in Coral Gables. The dining and entertainment bowling venue is taking 30,000 square feet on two stories at the project. Agave Holdings, a group that includes the family behind the Jose Cuervo spirits business, is the developer. Koniver Stern Group brokered the 15-year lease, according to a spokesperson…

The final act: Spaghetti western star sells Overtown warehouse for $10M

Spaghetti western movie star Francisco Martínez-Celeiro sold his Overtown warehouse in an Opportunity Zone for $9.5 million. Rumasa Corp, which is tied to Martínez-Celeiro, sold the 72,903-square-foot warehouse at 690 Northwest 13th Street to a company tied to Kite Tax Lien Capital of Vero Beach. The building sits on 2.6 acres of land next to Booker T. Washington Jr. High School. It sold for $130 per squar…

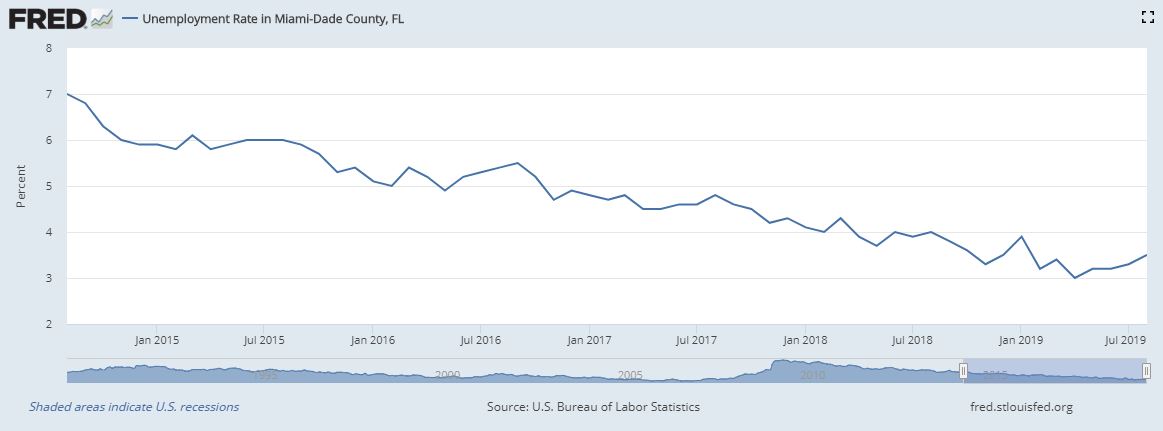

New York’s Rent Reform Pushes Investors Toward South Florida

Following the enactment of New York’s latest rent regulations, many multifamily investors have begun reevaluating their options. One of the most common destinations they’re choosing is Florida, particularly its southern part. Not only does the Sunshine State offer a favorable climate, an abundance of luxury properties and substantial tax savings, but it also seems to be far from adopting rent control…

Deforunta Profiled by Forbes; Traits Of A Successful Real Estate Investor

The traits of successful real estate investor often surface early in life then evolve to play a fundamental role in a career. Here’s three investors/developers who have stayed in the game with big wins. Edgardo Defortuna’s Fortune International Group is recognized as a leader in high-end luxury real estate throughout South Florida, Latin America and Europe. Defortuna came to Miami in 1983 from…

In South Florida’s Multifamily Market, Only (Expensive) Scraps Are Left

Phil Rosen was watching the cranes from his Fort Lauderdale office and marveling at how long and strong the region’s real estate boom has been. He’s a transactional attorney, not a broker, but he’s grown accustomed to getting calls from agents sniffing around for off-market deals. Lately, the volume of such calls has tripled. “People are desperately looking for product,” said Rosen, the chair of law…

Shoma Group’s Ten30 South Beach Breaks Ground

Miami-based Shoma Group recently commemorated the groundbreaking of Ten30 South Beach, a curated collection of 43 studio, one- and two-bedroom condominiums nestled in one of South Beach’s most vibrant neighborhoods. In a nod to the development’s name, the ceremonial groundbreaking was held on October 30 at 10:30 a.m. at the future site of Ten30 South Beach. The project’s developmen…

High rent relative to income in Miami, other U.S. cities

The cost of rent in the U.S., particularly in certain metro areas, is too darn high. Nearly half of U.S. rental households are spending more than the recommended 30% of their income on rent, according to a report from Apartment List. (The national rate went from 49.5% in 2017 to 49.7% in 2018.) And according to Apartment List, “in 19 of the nation’s 25 largest metros, a household earning the median…

Q&A: South Florida Office Market Remains Healthy Heading into 2020

As the calendar inches closer to 2020, South Florida’s office market is experiencing stable fundamentals. Rent continues to grow, vacancy rates are low and construction is at record levels. Connect Media asked Stephen Rutchik, Executive Managing Director of Office Services in Colliers’ South Florida office, to share insights about South Florida’s office market as we move closer to 2020. Check out his responses…

Vlad Doronin, partners score $243M loan for Edgewater tower

Russian billionaire Vlad Doronin’s OKO Group and its partners scored a $243.3 million construction loan for its Missoni Baia condo tower in Miami’s Edgewater neighborhood. OKO Group, Oleg Baybakov’s OB Group and Cain International secured the loan for the 57-story, 249-unit luxury development at 777 Northeast 26th Terrace from Security Benefit Life Insurance Corporation. The project launched sales…