Parkway, KKR Complete $10M Renovation of Brickell Miami Office Tower, Sign Three Retail Tenants

Parkway Real Estate Services LLC and joint venture partner KKR have completed their $10 million renovation of Sabadell Financial Center, a 30-story, 524,000-square-foot office tower at 1111 Brickell Avenue. The waterfront property overlooks Biscayne Bay. Parkway Real Estate and KKR acquired the property for $250 million in 2018 and immediately…

Airport Villas apartment complex near Miami International Airport Sold

The owner of Cervera Real Estate Ventures acquired two apartment buildings near Miami International Airport for $13.2 million, with plans to redevelop the site for a future development project. Javier Cervera Jr. purchased the two-building, 90-unit complex known as Airport Villas at 4325 to 4335 Northwest South Tamiami Canal Drive for $147,000 per unit…

Dezer Development Settles ‘Hostile Workplace’ Suit Brought By Former COO

Father and son developer duo Michael and Gil Dezer have settled the lawsuit the former chief operating officer of Dezer Development brought against them following contentious testimony. The undisclosed settlement between plaintiff Andrew Chesnick, who worked for Dezer Development from 2013 until 2015, and the Dezers was confirmed in front of Circuit…

Doctor’s orders: developers increasingly tap medical experts, amenities

Amid the coronavirus pandemic, wellness services at developments have expanded to include an array of medical amenities, and gone far beyond luxury residential projects. Crocker Partners, one of Florida’s biggest office landlords, even hired a doctor to fill a new role for the company: director of environmental health. By hiring Dr. Walter Okoroanyanwu, Boca Raton…

“We’re moving into this new normal”: Retail landlords are finally getting paid

After months of skipping out on rental obligations due to the coronavirus pandemic, retailers are getting closer to making their landlords whole. Over 72 percent of national chain retailers paid their July rent as of mid-July, according to the latest report by Datex Property Solutions. That’s up from 62 percent just a month ago. “We’re moving into this new normal…”

Pair of mixed-use towers due in Wynwood

On the eastern side of growing Wynwood a developer plans a large mixed-use residential project that will also bring in new commercial tenants. PRH CHO Dragon Wynwood LLC plans to build the pair of neighboring buildings at 2804, 2810, 2819, 2828, and 2838 NW First Avenue. The city’s Urban Development Review Board considered the project at a virtual meeting…

Property appraisers seek to help landowners with taxes

Florida’s elected property appraisers are collaborating to help property owners throughout the state pay their taxes amid the greatest economic and housing crisis in a decade, according to Miami-Dade Property Appraiser Pedro Garcia. With the cooperation of state legislators, who have shown “100%” willingness to discuss solutions, he said, relief for those struggling…

Brightline might bypass five new rail platforms

New commuter rail in Northeast Miami-Dade would have up to five new platforms along Florida East Coast Industries’ line between downtown and an upcoming Aventura station but FECI’s Brightline won’t necessarily stop at any of them, a company executive says. After local government committed five years ago to bringing Tri-Rail downtown, FECI Senior…

Midrise housing due in Miami Health District

A developer plans to construct an elegant mid-rise multifamily residential building near the City of Miami’s Health District. Applicant Jesus Gonzalez Pereda presented plans for The Spot, to rise on a vacant lot at 1510 NW 16th Terrace. The project is designed as an 8-story building with 38 dwellings and parking for 43 vehicles. The city’s Urban Development Review Board…

Forget coulda woulda shoulda and hail South Dade transit

There’s good news and bad news for South Dade’s commuters. The good news is that after years of wishing and begging, they’re about to get new, fast, comfortable, reliable mass transit that could save them an hour or more every workday. The bad news is that the transit system’s name contains the word bus. That’s been the issue for years: a 20-mile transit…

Wynwood Business Improvement District used Zika model

Since the start of the pandemic, the Wynwood Business Improvement District has been ahead of the game by preparing its business members and stakeholders for what was to come. The improvement district already had an operating model: after the outbreak of the Zika virus back in 2016, leaders devised a game plan for what to do in the event of another…

Austin Hollo: Helping to direct family-created Florida East Coast Realty

Here’s a bit of trivia every Miamian should know: What is the tallest skyscraper in Florida, as well as the loftiest residential building south of New York? The answer: Panorama Tower, an 85-story, 868-foot-high marvel in Brickell boasting 821 luxury apartments, hotel and office space, and other commercial accommodations. Austin Hollo, senior vice president…

Gap claims it doesn’t have to pay rent at any of Brookfield’s malls

Gap Inc. is firing back at landlord Brookfield Property Partners, a month after the latter sued the retailer for withholding rent. Five of Gap’s chains — Gap, Athleta, Banana Republic, Old Navy, and Janie & Jack — sued Brookfield affiliates, claiming that its obligations to pay rent ended when government restrictions forced the company to close stores across the…

Biden’s tax plan would “pull the rug out” from under the real estate industry: insiders

Joe Biden went after one of the real estate industry’s favorite tax benefits Tuesday when he proposed funding a child- and elderly-care spending platform by closing off a loophole used by property investors. The presumptive Democratic presidential nominee proposed eliminating 1031 “like-kind” exchanges for investors with annual incomes greater than…

Knotel seeks to raise $100M in a serious down round

Knotel is reportedly trying to raise $100 million in funding in a round that would significantly lower its valuation, as the co-working firm grapples with plunging revenues and mass layoffs. The company has been in talks with a European firm for the funding since the beginning of the year, according to Forbes. The new investment would be at terms that could…

Massa Investment buys Paris Theater in Miami Beach for $13 Million

Massa Investment Group bought the Paris Theater on Miami Beach at 555 Washington Avenue for $13 million. Miami-based Massa Investment Group, led by Mathieu Massa, bought the 25,589-square-foot building for $508 per square foot, records show. Big Time Productions, led by Eugene Rodriguez, sold the property. The building…

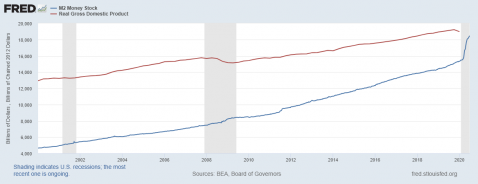

State-level GDP losses during the pandemic : Mapping the range of economic decline across the U.S.

FRED has the latest state-level GDP data for 2020, and there’s a range of economic decline across the United States. This GeoFRED map shows regional differences in how state economic growth has been affected by the COVID-19 outbreak—from 8% declines in Nevada and New York to a 1.3% slump in Nebraska. What determines how a state’s economy is affected?

Here’s how much Covid has crushed global RE investment

Global real estate investment was slammed over the first six months of the year, falling by a third compared to the same period last year. But amid the coronavirus-fueled hurricane a couple of sectors have been holding up, according to a new report from Savills, cited in Bloomberg. First the bad news: The Asia-Pacific region, where the virus first flared…

Downtown Fort Lauderdale dev site hits market for $12.5M

A development site sandwiched between Fort Lauderdale’s Flagler Village and the New River hit the market for $12.5 million. The property at 150 North Federal Highway includes a two-story 9,653-square-foot office building that was built in 1985. The site, near Virgin Trains USA’s Fort Lauderdale station, is listed with Native Realty founder and CEO Jaime…

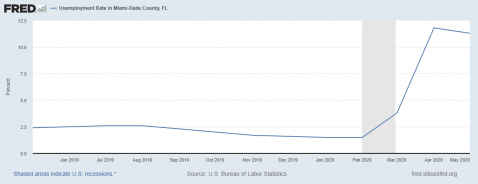

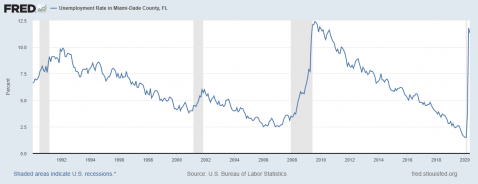

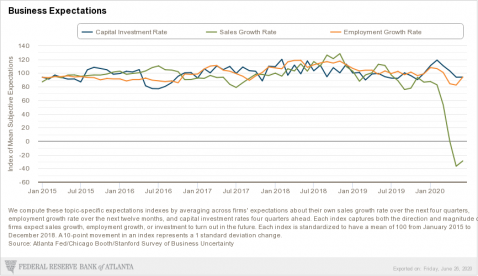

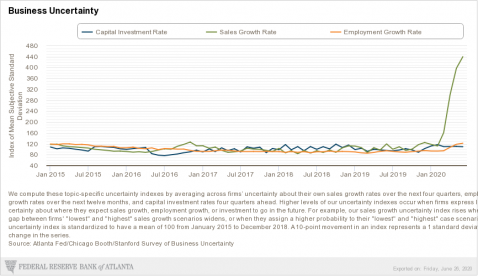

COVID-19 South Florida Real Estate Market Segment

South Florida economic and real estate market fundamentals were very strong when the stay home orders took effect in March. Market performance in March and in the first quarter of 2020 exceeded that of the same period in 2019 despite the COVID-19 interruption. Positive factors such as negligible delinquencies, lack of a subprime mortgage crisis…

US sports teams carry on with real estate projects, 2020 season or not

One Cardinal Way Over the last several years, sports teams across the country have spent big money developing real estate around their stadiums with the goal to attract visitors — and their money — for more than just games. While the coronavirus pandemic has halted large spectator sports events across the world, sports franchise owners are staying the course…

Flexible leases, greater services: Covid accelerates shifts in office market

In the office market, the pandemic has proved the “great accelerator.” That’s according to Susan Freeman, a London-based partner in the real estate department at Mishcon de Reya, who joined Nelson Mills of Columbia Property Trust to discuss the future of office for a recent episode of TRD Talks Live. The executives said that in both the U.K. and U.S. markets…”

Integra, partners pick up waterfront dev site next to Jockey Club for $16 million

Integra Investments and two partners purchased an 8.2-acre waterfront development site just north of Miami Shores for $15.5 million. The Miami-based real estate firm, along with Andrew Korge of Korgeous Group and David Larson of DCL Capital, acquired the site at 11295 Biscayne Boulevard for $43 per square foot, according to a release. Jockey Segal LLC, led by…

Developer buys Miami Worldcenter site for mixed-use project

Miami Worldcenter’s developers sold a site at the megaproject for $18.85 million to Akara Partners, which plans to build a mixed-use project. Miami Worldcenter sold 36,273 square feet of developable land to the Chicago-based development group, and another 8,227 square feet of undevelopable land underneath the Metromover. The two pieces of land total 1 acre…

Bridge Investment wants to raise another $600 million for its Opportunity Zone funds

Bridge Investment Group said it plans to raise another $600 million through its Opportunity Zone funds between now and the end of this year. The company announced this week that it had already raised $1.3 billion through the funds since launching in October 2018 with a $500 million target. Most of that money has already been deployed to projects around…

Miami-Dade approves $35 million aid package for restaurants, employees

Miami-Dade County restaurants and employees in financial straits could see some additional help from the federal government. Miami-Dade County commissioners on Thursday approved a $35 million aid package for restaurants and their staff, which includes providing $500 checks for laid-off workers, according to the Miami Herald. The plan is to use about 7…

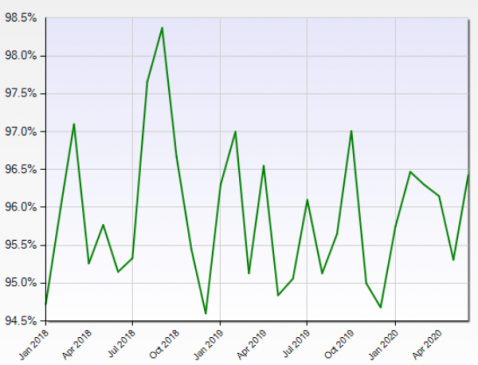

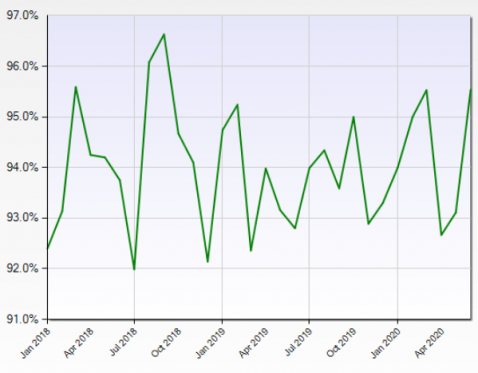

Co-living execs offer glimpse at occupancy rates

Before the pandemic, co-living executives were looking to capitalize on demand for shared, low-cost accommodation — specifically targeting young professionals in major cities. But now, with thousands of units in the pipeline, the pandemic has called the sector’s business model into question — and executives are predicting a tough 12 to 24 months, according…

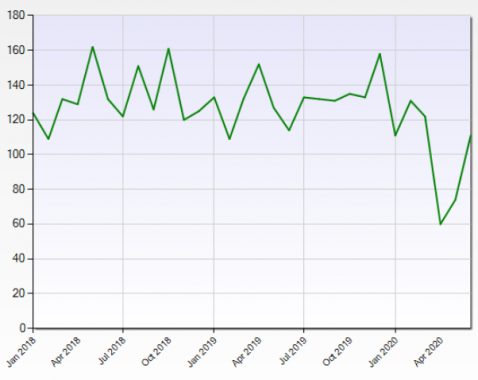

Hotels’ comeback stalls nationally, skids in NYC and Miami

Hotels’ recovery appears to have stalled. From mid-April through June, occupancy rates climbed steadily following their historic coronavirus plunge. But they fell in the week ending July 4 and last week they were essentially flat, according to newly released data from industry tracker STR. Occupancy rose by 0.3 percentage points to 45.9 percent in the week…

Retail sales increased in June — but surge in infections could signal trouble ahead

Retail sales increased in the U.S. by 7.5 percent in June, exceeding expectations as stores across the country began to reopen. The total estimated value of the sales was $524.3 billion, statistics released Thursday by the Department of Commerce show. The figures follow a record 17.7 percent jump in May, and June’s dollar volume is the closest to January’s…

Coral Gables Adopts Emergency Order Expanding Temporary Use Permits Due to COVID-19

In recognition of the impacts of COVID-19 on the local economy, the Coral Gables City Commission recently tasked staff with finding additional creative ways to support businesses and encourage individuals to participate in the local economy. On Tuesday, July 14, 2020, the City Commission adopted an emergency ordinance adding a section to the…

Triple Five, Terra, Starwood sue Miami-Dade property appraiser over tax bills

Affiliates of megamall developer Triple Five, along with Terra and Starwood Capital Group are crying foul over property tax bills from Miami-Dade County. A number of developers and investment groups have recently filed lawsuits against Miami-Dade Property Appraiser Pedro J. Garcia for their tax appraisals for the 2019 tax year. Others include the owners of…

Don Peebles Developer Don Peebles founded his eponymous firm in 1983. Since then, the Peebles Corporation has built out a portfolio that totals $6 billion and spans more than 7 million square feet in Boston, Los Angeles, Miami, New York, Philadelphia, San Francisco, Washington, D.C., and Charlotte, North Carolina. Peebles has long been outspoken about the…

Commissioner Pushes Miami Water Park Project Despite Environmental Concerns

Once upon a time, Miami-Dade County almost had a major amusement park meant to rival Disney World and Universal Studios. The plan to construct a theme park on Zoo Miami property near environmentally sensitive land was seemingly killed by a beetle around 2016. But the project didn’t die. Instead, it has morphed into a plan to build a water park on top of a…