Core pays $19M for shopping center near FIU

Core paid $19 million for a shopping plaza near Florida International University’s Modesto A. Maidique Campus in west Miami-Dade County. The Miami-based real estate investor, through an affiliate, bought the retail property at 9720 Southwest Eighth Street from two sellers tied to Miami-based Orion Real Estate Group, records show. The seller bought the…

‘We Can’t Raise Rents Fast Enough’: South Florida Multifamily Market Soars (But So Do Costs)

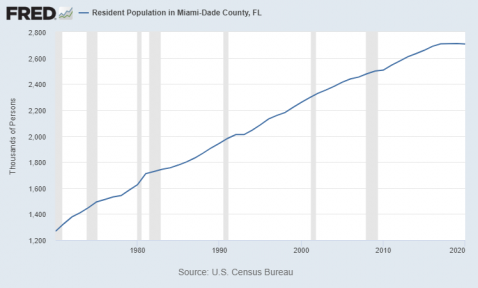

In South Florida, where the population is booming and homeownership is out of reach for many, multifamily developers have been able to command high rents in their fully leased apartment complexes. But building new projects is challenging because land is only available between the ocean and the Everglades, and savvy sellers are not letting go of their…

Lynd pays $40M for Miami Gardens apartments

Lynd bought a Miami Gardens apartment complex for $40.1 million, marking the group’s second South Florida multifamily purchase this year. San Antonio, Texas-based Lynd purchased the 234-unit Parc Place Apartments at 17600 Northwest Fifth Avenue in an off-market deal, according to a news release. The price breaks down to $171,282 per unit.

Biden ends talks with GOP on infrastructure, turns to Plan B

Following a week of fruitless negotiations with Senate Republicans to fund a $1 trillion infrastructure plan, President Joe Biden ended the talks without a deal. The failed bargaining efforts concluded with a Tuesday call with Sen. Shelley Moore Capito of West Virginia, the lead Republican negotiator, the New York Times and other outlets reported. Republicans had long been…

Clevelander wins lawsuit against Miami Beach over alcohol rollback

Miami Beach’s attempt at curbing late-night partying by ending alcohol sales earlier was overturned in court. The decision is a win for businesses that opposed the rollback but bad news for developers who say the city needs to reinvent its image in the entertainment district. The Clevelander South Beach, a hotel with a restaurant and bar known for its all-day…

Miami Condo Building To Install World’s Largest, Tallest Automated Parking System

A New Jersey-based company has been contracted to install a robotic parking system in a 46-story condo building in Miami. It will be the largest and tallest automated guided vehicle, or AGV, parking system in the world, according to a May 26 announcement from Park Plus, which is taking over the job after a different parking provider allegedly installed a faulty…

Terra puts Bay Harbor Islands mixed-use dev site under contract

Terra has a development site along Bay Harbor Islands’ Kane Concourse under contract, with plans for a residential, office and retail project. Coconut Grove-based Terra, led by David Martin, intends to purchase the 2-acre vacant property at 1177 Kane Concourse from NR/Wharton Kane Concourse Property Owner, according to a letter filed with the town.

PMG Developing Condo Project With Miami ‘Ultraclub’

The $40M venue E11even Miami has been described as a strip club, “technically not a strip club,” a club where dancers just happen not to have tops on and “an R-rated version of the alien bar in the opening sequence of Star Wars, but add in a great sound system with strippers.” Its website defines it as an “ultraclub.” Whatever the definition, it is popular.

Black Lion doubles down on Miami with purchase of Wynwood Arcade, Amara at Paraiso

Robert Rivani’s Black Lion Investment Group purchased the Wynwood Arcade and the nearby Amara at Paraiso property in Miami’s Edgewater for more than $25 million combined, as the firm doubles down on South Florida. The two sales mark another sign of rising demand for retail and restaurant properties in Miami. East End Capital sold the Wynwood…

Daniel Sundheim’s D1 Capital Partners inks 10-year Coconut Grove office lease

Daniel Sundheim’s D1 Capital Partners is the latest investment firm to plant a flag in Miami. The New York City-based hedge fund signed a 10-year, 25,000-square-foot office lease at Related Group’s new building in Coconut Grove, where the developer is now based. The building, at 2850 Tigertail Avenue, is now fully leased, according to a release. D1 lost $4 billion, or…

Miami-Dade gets rent check from casino giant Genting for $10 million

Miami-Dade got a big check in the mail last week: $10 million from the Genting Group as part of the Malaysian casino giant’s nearly century-long rental of space above an Omni bus station north of downtown Miami. The one-time payment precedes planned construction of a 36-story hotel and retail center on Northeast 14th Terrace. The county and Genting…

Coral Gables turning up the volume at downtown eateries

A Coral Gables ordinance to allow outdoor live amplified music on private ground level for private establishments in the Central Business District has gotten a preliminary go-ahead. During Tuesday’s city commission meeting, city officials voted 4-1 to move forward with an ordinance that would create an additional exemption to the city’s noise ordinance allowing…

Property Appraiser lists Miami-Dade taxable values as up 3.6% countywide

Countywide taxable property values in Miami-Dade rose 3.6% last year, according to an estimate by Property Appraiser Pedro Garcia. The estimate includes both new and old construction. Properties that existed a year ago as a group rose 1.9% over the period, an increase of $6.28 billion in value, Mr. Garcia’s estimate shows. The rest of the increase was attributed…

Battle for their apartments: Hamilton on the Bay tenants in Miami’s Edgewater fight Aimco’s lease terminations

Hamilton on the Bay Tenants of a prized multifamily property in Miami’s Edgewater are fighting back after their landlord notified them that their leases are being terminated, The Real Deal has learned. Tenants of the Hamilton on the Bay apartment building are being asked to leave by July 16, according to a lease termination letter obtained by TRD. Aimco…

Miami Beach board approves pharmacy for North Beach project

Developer Aria Mehrabi’s future 12-story mixed-use project will now include a pharmacy, in spite of a recommendation from Miami Beach’s planning department to reject the request, due to its proximity to another drugstore. By a vote of 6 to 0, Miami Beach’s Zoning Board of Adjustments on Friday approved variances that will enable a CVS pharmacy to…

Ubiica, Maven buy Coral Gables office building, parking lot for $9 million

Ubiica and Maven Real Estate bought a Coral Gables office building and parking lot for $8.7 million. The partners bought the two-story property at 1533 Sunset Drive and the 10,000-square-foot parking north across San Ignacio Avenue, said Alejandro Salazar, Ubiica’s manager. The seller is Winter Garden, Florida-based Windsor Investments, managed by…

Miami among cities where the most self-storage space was built in the past decade

The self-storage sector added about 300 million square feet of new supply over the last decade, as the number of apartments grew and the size of each unit fell. People in the self-storage industry often talk about the “four Ds” that drive demand for their business: death, divorce, dislocation, and downsizing (or disaster, or density, depending on who you ask). The past…

Miami Makes List of Top 10 Markets for Self Storage Rent Growth

The self storage sector has established itself as a strong performer, despite troublesome market conditions over the past year. Thanks to its countercyclical nature and low sensitivity to changes in the economy, the sector could capitalize on the demand fueled by the pandemic-induced relocations and displacements across the country, leading to…

8.5-Acre Medley Development Site In Booming South Florida Industrial Market Purchased

Hilco Redevelopment Partners (HRP), a unit of Hilco Global, just announced the purchase of an industrial development site located at 11002 Northwest South River Drive in Medley. The 8.5-acre property is part of a larger 25-acre Superfund site which has previously undergone corrective action. HRP has current plans to develop the site into a state-of-the-art…

What Joe Biden’s infrastructure plan holds for real estate

President Joe Biden offered a series of concessions to Senate Republicans this week, the White House said, as he negotiates passage of his $1 trillion infrastructure deal — a plan that would have huge implications for the real estate industry. In an Oval Office meeting, Biden proposed that a new corporate version of the alternative minimum tax would be imposed…

Economic recovery quickens from crawling to merely slow

The economic recovery can’t get here fast enough. Employers added back 559,000 jobs to the U.S. economy in May, more than double the number in the previous month. While that is confirmation that the economy is recovering from the pandemic, it’s coming back at a slower pace than economists had predicted. The gains were “lower than anticipated…”

Restoration Hardware to open Miami Design District store

Restoration Hardware, now known as RH, is planting a flag in the Miami Design District, The Real Deal has learned. The high-end furnishings retailer inked a lease at Apollo Commercial Real Estate Finance and the Comras Company’s buildings on the west end of the Design District, according to sources. Michael Comras confirmed that Restoration Hardware…

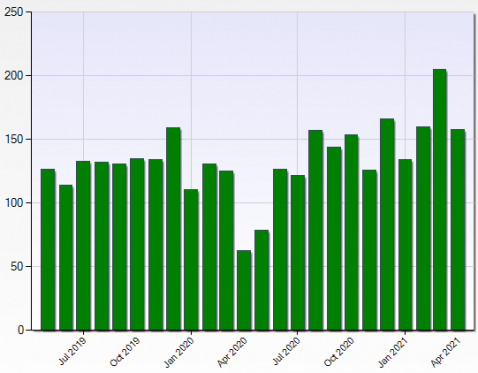

Retail Real Estate Leases – Q2 2021

The South Florida retail real estate market is witnessing quite a bit of activity despite the influence and presence of the pandemic, and it seems it is turning the page. There are several factors for this, but two primary reasons are: 1) Florida is back in business and has been open earlier compared to other…

The Fed: A V-shaped recovery : Tracking GDP in the G-7 through COVID-19

The pandemic-driven recession started in the first quarter of 2020. After a year, it appears the recession is nearly at an end. The FRED graph above tracks this downturn in GDP for countries in the G-7, all indexed to 100 in Q4 2019. The full legend is large, so we’ve removed it from this graph. Simply mouse over the graph to read the series titles and identify…

The Fed: Beige Book Contacts Figure Labor Shortages Will Improve by Fall

Some Atlanta Fed business contacts expect worker shortages, particularly for lower-wage jobs, to become less troublesome by the fall. Already, pressure to increase wages across the Southeast picked up from April through the middle of May, most notably for low-skilled positions, according to the new Beige Book report of regional economic conditions…

Miami board delays vote on revised Little Haiti mixed-use project

The development team of Sabal Palm Village aims to replace low-rise Design Place with a high-rise community with public spaces and bike paths. For the ninth time, the city of Miami’s Planning Zoning and Appeals Board deferred voting on a controversial mixed-use, high-rise project that would exceed 5 million square feet. It’s slated to replace the 512-unit Design…

Despite Shutdown, Brightline Still Drives South Florida’s ‘Rail Estate’ Market

A pandemic-driven suspension of the Brightline train service has endured for more than a year, yet it hasn’t derailed real estate investment near its South Florida stations. Brightline, which launched its passenger rail service in 2018, currently connects Miami to Fort Lauderdale and West Palm Beach, at downtown train stations in each city. Service, which was suspended…

Blackstone, Starwood up bid for Extended Stay America

Blackstone Group and Starwood Capital Group are once again trying to woo Extended Stay America’s shareholders. The two firms announced Tuesday that they would increase their offer to buy the hotel operator to $20.50 per share, Bloomberg News reported. In March, they agreed to buy the company at $19.50 per share. But some of Extended Stay’s shareholders…

Investors pour $10B into life sciences real estate this year

The future of the office sector remains largely uncertain at this point post-pandemic, but there’s one segment that continues to see huge gains. Investors have spent more than $10 billion on buying life sciences buildings this year, Bloomberg News reported, citing data from Real Capital Analytics. That’s about 4 percent of all global commercial real estate transactions…

This startup creates community to help landlords retain tenants

A property tech startup is betting that New Yorkers, after a year spent huddled inside, could use a little help meeting and mingling with their neighbors. The firm, Venn, just raised $60 million in venture capital — funds earmarked, in part, to build out its New York footprint. The company launched its eponymous app in 2017 as a hyperlocal social network…

South Florida’s Outlying Markets, From Belle Glade To Treasure Coast, Heat Up

For years, economic developers in Palm Beach County pitched the rural Glades region as an up-and-coming area for industrial development. And for years, splashy deals failed to materialize. That recently changed, when Apopka-based Finfrock, a maker of precast concrete buildings, bought 94 acres on the site of a former state prison in Belle Glade, located just off…

Miami commissioners approve West Grove bed-and-breakfast

A bed-and-breakfast complex planned for the West Grove is moving forward, despite neighboring homeowners’ objections to rezoning the development site due to fears of gentrification. The Miami City Commission last week voted in favor of changing the zoning for six lots near 3227 Charles Avenue in Miami’s Coconut Grove from single-family residentia…

Aventura office complex trades for $93M

Real estate investor and motivational speaker Grant Cardone bought the Harbour Centre at Aventura office complex for $93 million, The Real Deal has learned. Cardone bought the offices at 18851 Northeast 29th Avenue next door to his 10X headquarters. He envisions merging the two properties into a walkable mixed-use campus with affordable housing, he said.

Michael Swerdlow’s Block 55 in Overtown lands nearly $8 million affordable housing grant

A Michael Swerdlow-led mixed-use project in Miami’s Overtown neighborhood at 249 NW 6th Street is getting local government financial assistance for its affordable housing component. Miami city commissioners on Thursday unanimously approved awarding an additional $2.5 million grant to Block 55, after previously giving the project $5 million last year.

Miami-Dade looks to a Center for Genetics of the Americas

While Miami-Dade is already working to attract genetics-focused organizations and businesses, more can still be done, including the possible creation of a Center for Genetics of the Americas, Mayor Daniella Levine Cava’s administration says. The genetics industry – which encompasses life science, healthcare, agriculture and genomic research, among others…

Mixed-income housing across from Marlins Park wins OK

A plan for new construction of an attainable mixed-income residential development called Paseo del Rio earned the praise of a City of Miami review board. The seven-story, 182-unit building is planned for county-owned property at 1401 NW Seventh St., across from Marlins ballpark. The Urban Development Review Board unanimously recommended approval…

Underdeck connector to follow vast signature bridge/I-395 project

As Downtown Miami approaches another busy summer abuzz in construction, steady progress continues on the I-395/SR 836/I-95 Design-Build Project. An added benefit to improved freeway surfaces is the plan to reconnect areas to downtown, including Overtown, Edgewater and the Omni neighborhood. Miami commissioners approved the first step…

Micro-mobility infrastructure plan targets downtown Miami

A micro-mobility infrastructure project half funded by electric scooter fees could be coming to downtown Miami, adding about three miles of protected bicycle and scooter lanes and laying the groundwork for more lanes in the future. The green-patterned pavement lanes, which would come with concrete barriers separating them from traffic, would run from…

Lack Of Land Has Industrial Developers Looking To Take Over Florida’s Golf Courses, Lakes And The Everglades

As senior vice president for Duke Realty, Stephanie Rodriguez oversees a portfolio of industrial properties in South and Central Florida, a geography with limited space and shrinking new development options. “We’re all fighting over the same pieces of dirt,” Rodriguez said during a May 12 Bisnow South Florida Industrial Update event. “Industrial is the…”

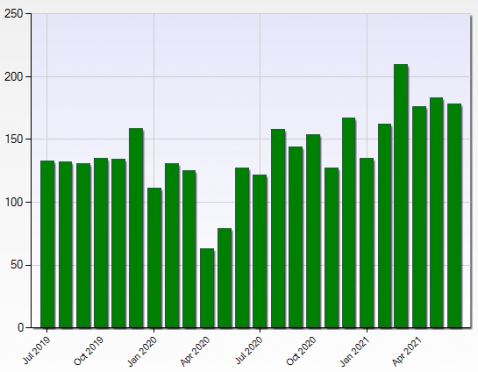

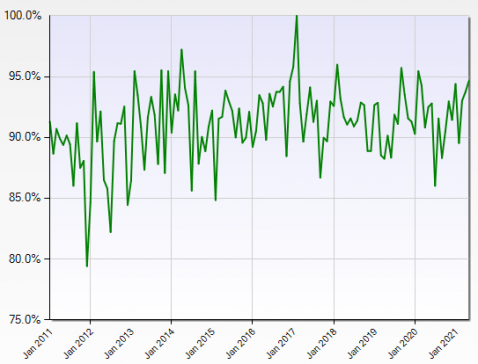

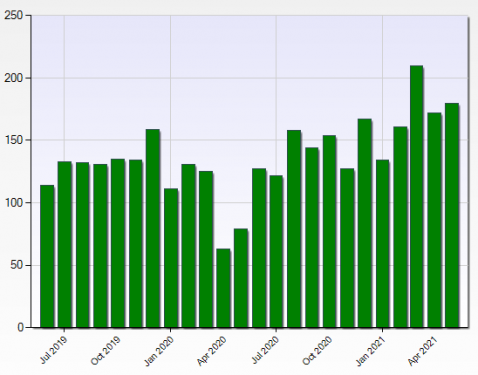

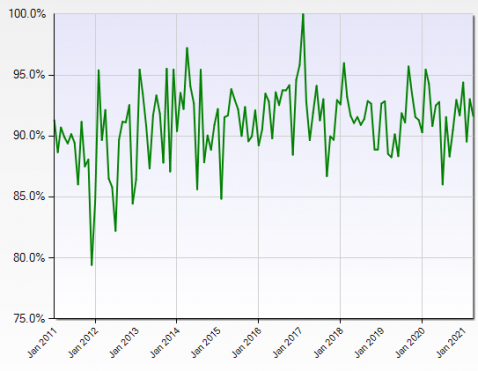

Chart: Miami Commercial Real Estate Sales to List Price Ratio April 2021

January 2011 to April 2021 Sales to List Price Ratio for Commercial/Industrial Property within Miami-Dade County, Florida and Priced from $1 Million to $10 Million as Recorded in Miami MLS The chart above shows the sales to list price ratio as reported by the Miami MLS for improved commercial real estate (MLS classification: commercial…)

Ugo Colombo’s The Collection nabs $65M construction loan for second Coral Gables dealership

Ugo Colombo’s The Collection luxury dealership scored a $64.5 million construction loan for a second Coral Gables location. The Collection, led by Colombo and president and CEO Ken Gorin, is building the Jaguar and Land Rover dealership on about 2 acres at 125, 155 and 163 South Dixie Highway. JP Morgan Chase Bank is the lender, records show. Jaguar sales will be transferred to the new location from The Col…

Mila Group, partners plan hotel and restaurants on Miami River site

A boutique hotel, beach club and two restaurants are planned for a Miami River site, four years after plans for a Sushi Samba eatery fell through. Miami Beach restaurateur Gregory Galy’s Mila Group, in partnership with developer Pacific Star Capital and a Spanish investor, bought the property at 40 Southwest North River Drive from an affiliate of the Melo Group…

LeFrak buys Normandy Isle apartments in Miami Beach for $25M

LeFrak bought the Marina Del Rey apartments in Miami Beach’s Normandy Isle for $24.5 million. The Finvarb family sold the 108-unit waterfront complex at 1006 and 1022 Bay Drive. The sale breaks down to 226,852 per unit. Calum Weaver and Garrett Pordes of Cushman & Wakefield represented the seller in the deal. Marina Del Rey, which varies in…

$24.5M Sale Arranged of Marina Del Rey Apartments in Miami Beach

Cushman & Wakefield has arranged the $24.5 million sale of Marina Del Rey, a 108-unit waterfront apartment community in Miami Beach. Calum Weaver, Garrett Pordes, Robert Given, Zach Sackley and Troy Ballard of Cushman & Wakefield represented the seller, Finvarb Group, in the transaction. An entity doing business as 1006 Bay Drive LLC was the…

Anatomy Opens New 15,000 SF Location at Regatta Harbour in Coconut Grove

Anatomy has opened a new location at Regatta Harbour, a 9.5-acre mixed-use development underway in Miami. Anatomy is a progressive fitness community that integrates exercise programing with wellness and beauty. The Regatta Harbour location will be Anatomy’s fourth location in South Florida… Regatta Harbour’s first tenant… at 3385 Pan American Drive…

Black Lion Investment Group Acquires Amara at Paraiso Restaurant Property in Miami for $12.1M

Los Angeles-based Black Lion Investment Group has acquired a restaurant building in Miami known as Amara at Paraiso. The seller, Related Group, sold the property to Black Lion for $12.1 million. Fabio Faerman and Sebastian Faerman of Miami-based FA Commercial represented both parties in the transaction. Amara at Paraiso is a 12,300-square-foot…

Starved for relief: Restaurants seek $76B, far more than budgeted

The Small Business Administration is dishing out rent relief to restaurants, but many figure to go hungry. The demand for federal pandemic relief has far exceeded the amount of money available, so some restaurants, bars and other food businesses might not receive it, the New York Times reported. Restaurants could apply for relief starting May 3, and applications closed…

Miami Market Update: Development Pipeline Holds Steady

Miami’s under construction office stock has expanded to 2.4 million square feet by the end of April, registering a slight spike compared to March, according to CommercialEdge data, with most projects poised for completion by the end of the year. Under construction and planned stock amounted to 8.1 percent of the market’s total office footprint, down…

Flurry of Lease Deals Totals 70 KSF at Miami Tower

Three law firms and a federal government agency have signed a flurry of lease commitments totaling more than 70,000 square feet at Miami Tower located at 100 SE 2nd Street, Sumitomo Corp. of Americas’ landmark, 47-story office asset in downtown Miami. Gordon Rees Scully Mansukhani LLP inked a new, 9,726-square-foot lease at the I.M. Pei-designed skyscraper…

An Update on the South Florida Hotel Industry’s Post-COVID Recovery

COVID-19 caused a massive downturn in South Florida’s hotel industry, but an uneven recovery is underway It goes without saying that COVID-related lockdowns and panic caused a significant slowdown in South Florida’s service economy. Tourism, conventions, and general business travel are vital to the region’s financial stability, given the money they bring in…

Brookfield buys Comcast-leased Miramar building for $29 million

Brookfield Property Group paid $29 million for a Miramar building that is fully leased to Comcast. Brookfield, through an affiliate, bought the property at 15800 Southwest 25th Street from 15800 Building LLC, managed by Arturo Alvarez Demalde of AD4 private equity firm in South Florida, records show. Steve Medwin and Nick Wigoda of Newmark were the…

Feldman Equities buys Fort Lauderdale office complex for $59 million

Feldman Equities bought the Pinnacle Corporate Park office complex in Fort Lauderdale for $58.9 million. The Tampa-based investor bought the two buildings at 500 and 550 West Cypress Creek Road from a fund managed by DRA Advisors in joint venture with Banyan Street Capital, according to a news release. The deal breaks down to $226 per square foot. Brokers for…

Hudson Capital, Barron Commercial honchos buy Oakland Park shopping center for $23M

Longtime South Florida developers Steven Hudson and Charles Ladd Jr. bought an Oakland Park shopping center for $23.4 million. Records show Hudson and Ladd, through an affiliate, bought the Festival Centre at 3400-3570 North Andrews Avenue from Sela LLC, managed by investor Amos Chess. The buyers secured a $12 million loan from Starwood Mortgage…

ShareMD buys Boynton Beach medical office building for nearly $7M

ShareMD bought a Boynton Beach medical office building for $6.5 million, as it continues to invest in healthcare space. Alpharetta, Georgia-based ShareMD bought the building at 2828 South Seacrest Boulevard from Delray Beach-based Redfearn Capital, according to a news release. Elliot LaBreche and Abbe Kind of Easton & Associates represented ShareMD. The 31,747…