Rilea, Promanas buy Wynwood dev site, plan short-term rentals

The development site at 100 and 94 Northeast 29th Street and 101 Northeast 28th Street in Miami, Co-developer Rilea Group’s owner and CEO Alan Ojeda and president Diego Ojeda and co-developer Promanas Group’s president and CEO John Bogdasarian are pictured. A short-term rental project with 127 units is coming to Miami’s Wynwood neighborhood. Developers…

PMG flips former Johnson & Wales lots in North Miami for $10M

Michael Newman (President & CEO, Golub & Co.), 1660 Northeast 127 Street and 12600 Northeast 17th Avenue highlighted behind are pictured. Property Markets Group cashed out of three former Johnson & Wales properties in North Miami that the company acquired over the summer. The New York and Miami-based luxury residential developer sold a vacant lot…

Developer Lissette Calderon’s $100M Apartment Project Tips Cap To Miami’s History

Lissette Calderon, one of Miami’s only female developers, is breaking ground on a new $100M multifamily project and naming it after the woman who founded the city, Julia Tuttle, a widow who in the 1890s persuaded railroad magnate Henry Flagler to extend tracks into Miami and build a hotel, thus triggering a development boom. The Julia, a 14-story, 323-unit…

Developer Asi Cymbal Has $1B In Projects In The Pipeline In South Florida

Asi Cymbal is a trained lawyer, a developer and a licensed general contractor, but after a few years on the development sidelines, he is back in a big way. Cymbal worked on prominent New York projects like Downtown by Philippe Starck before moving to Miami and developing several office, retail and restaurant projects in and around the Design District through…

New York developers unveil plan for South Beach office project

Two New York-based development firms are teaming up to build a Class A office project in Miami Beach. Sumaida + Khurana and Bizzi & Partners are planning a five-story building with 56,177 square feet at 944 5th Street and 411 Michigan Avenue in the city’s South of Fifth neighborhood, according to a press release. An entity managed by principals of…

KKR and Parkway Sign 74,000 SF Lease with Millennium Management at 1111 Brickell in Miami

KKR, a leading global investment firm, and Parkway Property Investments, LLC (“Parkway”) announced the signing of a long-term lease with Millennium Management (“Millennium”) for more than 74,000 square feet across three floors at 1111 Brickell, a 30-story Class A office tower located in the heart of Miami’s Brickell submarket. Millennium plans to staff the…

Washington Nationals Owner Buys Apartment Tower In Miami

Lerner Enterprises, the Rockville, Maryland-based investment firm that owns the Washington Nationals, has picked up a 25-story apartment building at 8400 South Dixie Highway in Miami, adding to its portfolio of Florida properties. Lerner, a 70-year-old company with a portfolio of offices and 5,000 multifamily units, mostly around Washington, D.C., bought…

Spanish Private Equity Giant Sets Sights On U.S. In Partnership With Miami-Based Exan Capital

A major European private equity firm is joining forces with a Miami-based fund manager, giving them both international capabilities. Azora Capital, based in Madrid, with €4B of assets under management, is teaming up with Exan Capital through a joint venture, Azora Exan. The new JV will focus…

Israel Englander’s Millennium Management inks 74K sf Brickell lease

Billionaire Israel Englander’s Millennium Management is the latest Northeastern financial firm to head to South Florida, with plans to open an office in Miami’s Brickell. New York-based Millennium Management inked a long-term, more than 74,000-square-foot lease at the Sabadell Financial Center at 1111 Brickell Avenue, where the hedge fund will open an…

Surfside collapse mediation hits standoff, as rival sides dig in heels on disbursements

Mediation talks on divvying up disbursements among victims of the Surfside condo collapse have hit a stalemate, revealing two opposing sides that pit survivors who lost their homes against those who lost loved ones. In total, roughly a dozen views have been expressed on how funds should be allocated. But ultimately, opinions fall into three major groups…

Wholesale club wins $4M in suit over shoddy construction at Flagler Station warehouse

The biggest membership warehouse club operator in Central America and the Caribbean won a roughly $4.4 million award in a lawsuit alleging faulty construction at its Flagler Station warehouse at 11441 Northwest 107th Street. PriceSmart claimed in its complaint that the concrete floor slab at its 323,494-square-foot facility at the sprawling industrial complex…

Nearly 20 Acres Of Heavy Truck Land In Hialeah Gardens Sells For $872,000 Per Acre

A New York-based company paid a combined $17.25 million in three deals for 19.78 acres of heavy truck parking land a t15701 NW 127th Avenue near Hialeah Gardens. Both properties are outside the Miami-Dade County Urban Development Boundary, meaning major development requiring water and sewer services is not permitted. However, truck parking…

Brightline testing Miami to West Palm Beach to be ready to roll

Brightline passenger rail service is back on track. Stalled by the global pandemic, the fledgling rail service is ready to get moving again and has announced a relaunch for November. Brightline, which bills itself as the only provider of modern, eco-friendly high-speed rail in America, began testing its full operating train schedule between West Palm Beach…

$40 Million Coral Gables Mobility Hub targets self-driving, electric vehicles

Coral Gables city commissioners got the opportunity to see official renderings and a glimpse of how the Coral Gables Mobility Hub is going to change and elevate the city into the future. During last week’s city commission meeting, design and architecture firm Gensler presented in detail all the features the estimated $40 million mobility hub at…

Mexican owner of 32 aquatic parks wins Miami Seaquarium lease

County commissioners on Tuesday authorized assignment of the lease to operate and maintain the Miami Seaquarium on Virginia Key, a major county tourist attraction, from Festival Fun Parks LLC, a Delaware company, to MS Leisure Company Inc., a Florida corporation based in St, Augustine. The parent of MS Leisure is The Dolphin Company…

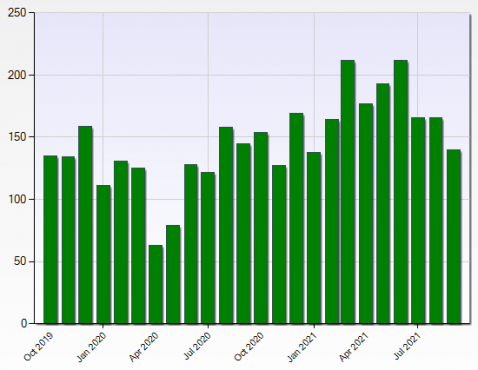

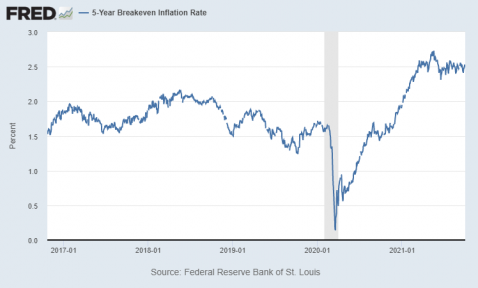

Video: Atlanta Fed’s Brian Bailey Presents View on Commercial Real Estate 2021

Brian Bailey, Real Estate Subject Matter Expert at the Federal Reserve Bank of Atlanta, shares his view on the commercial real estate market, including retail and office properties, supply chain issues, inflation expectations and the jobs outlook. He talks about the effects of vaccination rates on manufacturing and issues with people not being yet able to reenter…

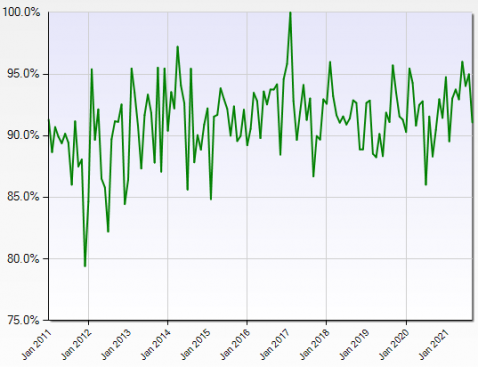

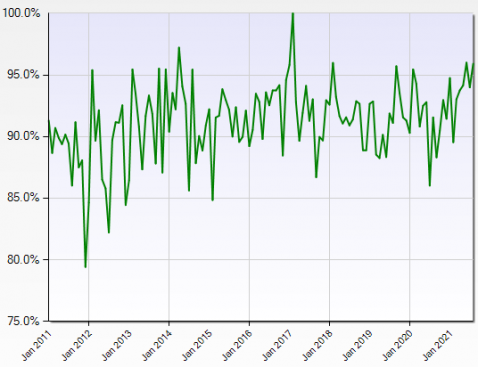

The Fed on How Widespread Price Increases May be in the U.S.

In the first blog post of this two-part series, I discussed the recent surge in inflation and identified some upside and downside risks for future inflation. In this second blog post, I will focus on evaluating whether higher inflation can be attributed to a small group of goods and services or whether it is a more generalized event. This exercise is motivated by…

Dan Gelber uncut: Miami Beach mayor caught on tape courting developers for Ocean Drive takeover

Miami Beach Mayor Dan Gelber and his predecessor, Philip Levine, courted unidentified developers to raise money for city commission candidates who favor Gelber’s agenda for Ocean Drive, and offered them carte blanche access to city staff for redevelopment proposals in the Art Deco Entertainment District. He also promised to push through unpopular…

Developers, Lenders Are Betting Big on Miami Multifamily

South Florida’s multifamily market continued its expansion—bolstered by in-migration from major metros and a business-friendly climate—throughout the health crisis. What’s more, private capital investors are cashing in, banks are closing on sizable construction loans and rental rates are on the rise. Lending and development power players in the area…

Don Peebles drops remaining $160M claims tied to Overtown development lawsuit

Don Peebles dropped his three pending claims for $160 million, ending his litigation alleging that he was duped out of developing in Miami’s Overtown. His decision came after his entity, Overtown Gateway Partners, which had filed the lawsuit last year, lost two counts over the course of the case. Following Overtown Gateway putting to rest all of its remaining…

Housing Trust Group Opens $25M Affordable Housing Community in Miami

Housing Trust Group (HTG) has opened Max’s Landing Apartments, a 76-unit affordable housing community located in the West Kendall neighborhood of Miami. The development cost was $25 million. Located at 8905 SW 169th Court, Max’s Landing Apartments is a three-story building with 56 one-bedroom, one-bath units and 20 two-bedroom, two-bath…

Ytech buys historic Nolan House in Brickell for $6M

A developer paid $6 million for the historic Nolan House, one of the few remaining original mansions that lined Miami’s Brickell Avenue in the 1920s. Ytech, a Miami-based company led by Yamal Yidios, bought the property at 1548 Brickell Avenue with renovation plans, according to a press release. Ytech declined to disclose its vision for the building…

Developer completes $70M Grand Station apartments — with A-Rod as an investor

The Grand Station Apartments tower is completed, built by a partnership that counts retired Yankees shortstop Alex Rodriguez as an investor. Residents have been moving into the 30-story, 300-unit downtown Miami building at 240 North Miami Avenue, according to developer Oscar Rodriguez. Rodriguez and his partner, Ricardo Vadia, both of…

Industrial space “effectively sold out” amid leasing frenzy, Prologis says

Global supply chain disruptions have sent industrial tenants into a leasing frenzy, pushing warehouse vacancy to unprecedented lows. Prologis’ portfolio was 98 percent leased and just under 97 percent occupied at the end of the third quarter, the San Francisco-based warehouse REIT reported Friday. Moreover, its development pipeline was already 70 percent…

Masoud Shojaee’s Shoma sells Doral apartments for $103M

Doug Andrews, Chairman, Avanti Residential; Masoud Shojaee, President & Chairman, SHOMA Group; Christian Garner, CEO, Avanti Residential; Sanctuary Apartment Complex at 9400 Northwest 41st Street, Doral, FL are pictured. Shoma Group sold its recently completed and fully leased Sanctuary apartment building in Doral for $102.5 million, marking…

Moishe Mana buys more land in Miami’s Allapattah

Moishe Mana is continuing to assemble land in Allapattah, as he says he is prioritizing his downtown Miami and Wynwood developments. Mana paid about $5 million for the industrial properties at 2300 to 2340 Northwest Seventh Avenue and 3100 Northwest Seventh Avenue in Miami’s Allapattah neighborhood, which is west of Wynwood and …

CRE survived Covid with flexibility, focus on convenience: report

Commercial real estate’s resilience through the pandemic hinged on its surprising flexibility and new focus on convenience — themes that will remain vital going forward, a report concludes. The industry held up far better than most professionals expected at the outset of the economic shutdown in March 2020, according to Emerging Trends in Real…

First-time fund managers bet $480M on self-storage across US

A pair of first-time real estate fund managers are betting half a billion dollars on the ever-resilient self-storage sector. Concord Wilshire, a Los Angeles-based developer, and Summit Investment Management, a Denver-based distressed debt investor, will put $480 million to work over the next four years buying and developing 40 self-storage facilities. The Miami…

End of eviction moratorium did not result in mass evictions

The mass eviction event feared by many when the federal moratorium ended in August has not come to pass — not yet, at least. Court eviction filings increased by 8.7 percent in the United States from August to September in more than 30 cities tracked by Princeton’s Eviction Lab. While that figure marks an increase, the Wall Street Journal reports the 36,796…

Like most alleged Ponzi schemes, a Miami-based troika’s plan to tap South American investors to fund their real estate projects started off with non-criminal, ambitious intentions. Ernesto Weisson, a Coconut Grove businessman and architect who spent time as a developer in his native Ecuador, teamed up with fellow Ecuadorian and financial manager…

Nuveen pays $110M for industrial buildings in Weston

Nuveen Real Estate bought two warehouses within the Weston Business Center for $110 million, marking the second biggest South Florida industrial deal this year. San Francisco-based real estate investment trust Prologis sold the properties at 2935 and 2945 West Corporate Lakes Boulevard, records show. The deal breaks down to $275 per square foot. Constructed…

Forte Capital Management buys Hollywood medical offices for $11M

Forte Capital Management bought a Hollywood medical office building adjacent to Memorial Regional Hospital South for $11 million. The Miami Beach-based company purchased the property at 3702 Washington Street, according to Chaim Cahane, president of Forte. A group of five doctors, including at least three with offices at the property, sold the building…

Pinnacle Housing to build affordable rentals in Hollywood

Rendering of the site on the southwest corner of Johnson Street and State Road 7 with the Regional vice president of Pinnacle Housing Timothy Wheat (Pinnacle Housing) Pinnacle Housing got the green light to build an eight-story, affordable apartment complex in the long-neglected U.S. 441 corridor in Hollywood, and may expand the project on an adjacent site.

Morgan Group won a land use change to develop 356 garden apartments on part of a shopping center in Pompano Beach, amid vacancies at the retail property. Houston-based Morgan plans to demolish a former Macy’s store and parking lot on a 12.1-acre site along the west side of Pompano Citi Centre, a shopping center on the southwest corner of Copans Road…

Crow Holdings pays $33M for Coral Springs’ Turtle Crossing

Michael Levy, CEO, Crow Holdings; Turtle Crossing Shopping Plaza, Coral Springs, FL (Crow Holdings, Google Maps, LoopNet) Crow Holdings bought the Turtle Crossing shopping plaza in Coral Springs for $32.5 million. A joint venture of Ross Realty Investments and SunCap Real Estate Investments sold the buildings at 5860-5884 and 5760-5772 Wiles Road as well as…

Art Falcone’s Encore Capital sells Plantation Walk office building for $58M

Vision Properties paid $57.5 million for the office building that is part of the Plantation Walk mixed-use development. Art Falcone’s Encore Capital Management, which developed Plantation Walk, sold the offices at 261 North University Drive, according to a news release. Records show the buyer, through an affiliate, took out a $37.4 million loan from…

Fort Lauderdale Beach hotel portfolio trades for $27M

Seven hotel properties at 3601, 3621, 3623, 3711, 3801, 3811 and 3821 North Ocean Boulevard on North Ocean Boulevard are bought for $27M. A family-owned, Coral Springs-based real estate investment firm is making a big splash in Fort Lauderdale Beach. Affiliates of LWHT Property Management, headed by Tom Assouline, paid a combined $27.2 million for six…

Rockpoint, InSite buy B Ocean Resort Fort Lauderdale for $127M

The beachfront B Ocean Resort Fort Lauderdale — formerly known as the Yankee Clipper — sold for $126.9 million, marking one of the biggest South Florida hotel deals this year. Boston-based Rockpoint Group and Fort Lauderdale-based InSite Group, through an affiliate, bought the 481-key resort for $117.9 million, records show. They paid an additional $9…

Jim Moran Foundation revs up Fort Lauderdale HQ plan with $10M site acquisition

A philanthropic organization founded by a late, prominent South Florida car dealer picked up an office development site for $9.8 million. The Jim Moran Foundation bought a 2.43-acre lot at 4545 North Federal Highway in Fort Lauderdale, according to records. The foundation plans to start construction next year on a new 50,000-square headquarters…

Cutting costs: Via Mizner mixed-use project in Boca Raton scores $335M financing

Penn-Florida Companies nabbed $335 million in new financing for the luxury mixed-use development Via Mizner in Boca Raton. New York-based Blackstone Mortgage Trust provided a $195 million senior loan secured by 101 Via Mizner, a 14-story, 336-unit apartment building at 101 East Camino Real. In a separate $140 million mortgage deal, Toronto…

IRA Capital makes $16M medical office play in Boca Raton

An Irvine, California-based private equity firm that focuses on medical real estate bought an outpatient center in Boca Raton. IRA Capital paid $16 million for a nearly 3-acre site with a single-story office building at 501 West Glades Road, according to records. The buyer took out a $12 million mortgage with Siemens Financial Service. The property is fully leased…

JB Capital and partner pay $26M for Fresh Market-anchored Jupiter retail center

A three-year-old, Boston-based commercial real estate firm led a $25.5 million joint venture purchase of Fresh Market Village in Jupiter. JB Capital Management acquired the 55,046-square-foot retail center at 311 East Indiantown Road, in partnership with Royce Properties LLC, a Woodbury, Connecticut-based family office, according to a release. The seller is…