Lerner Acquires Miami Tower for $114M

Looking to build up a portfolio of South Florida communities, Lerner Enterprises has acquired a 294-unit high-rise community in Miami. The company purchased Motion at Dadeland from a joint venture led by Adler Group and 13th Floor Investments, in partnership with Barings LLC, for $114 million. Lerner also received an undisclosed amount of financing…

Joint Venture Sells Motion at Dadeland Apartments in Miami for $114M

Adler Group and 13th Floor Investments, in partnership with Barings LLC, has sold Motion at Dadeland, a transit-oriented multifamily development in Miami. Maryland-based Lerner Enterprises purchased the 25-story property for $114 million. Located at 8400 South Dixie Highway, Motion at Dadeland features 294 market-rate rental apartments and approximately 8,000…

Foundry Commercial, GLP Kickstart Doral Industrial Project

Foundry Commercial and Modlo, the logistics platform of GLP Capital Partners, have commenced development of the Modlo Air Logistics Center in Doral, Fla. The project will add approximately 495,000 square feet of next-generation logistics space to the high-demand Miami-area market. The Modlo Air Logistics Center will take shape on a nearly 24-acre site that…

Foundry, Modlo Break Ground on 495,000 SF Modlo Air Logistics Center in Metro Miami

Foundry Commercial, in partnership with Modlo, the logistics platform of GLP Capital Partners, has broken ground on the Modlo Air Logistics Center, a three-warehouse property near Miami spanning over 495,000 square feet. The 23.7-acre site located at 7777 NW 41st St. in Doral once housed a PepsiCo bottling facility. The three structures include Building 1…

The Rational Exuberance Around Industrial Real Estate

The industrial sector is hotter than ever, no matter how you measure it. Soaring demand and plummeting vacancy rates are showing no signs of letting up in both traditional industrial subsectors and niche subtypes, including cold storage, data centers, multistory warehouse, domestic light manufacturing, and facilities that can accommodate just-in-time delivery.

Miami Beach mayor facing ethics complaint for Ocean Drive meeting

A recently filed ethics complaint accuses Miami Beach Mayor Dan Gelber of breaking a city law that prohibits elected officials from soliciting campaign contributions from real estate developers. On Wednesday afternoon, Ronnie Eith, one of four candidates running against Gelber in the Nov. 2 city election, filed a complaint against Gelber with the Miami-Dade…

SkyRise Miami developer settles lawsuit with theme park company over $1M refund

A quickly settled lawsuit offered new details about the planning of SkyRise Miami and developer Jeff Berkowitz’s efforts to recoup some of the pre-construction expenses for the canceled project. Over the summer, Berkowitz announced he scuttled the 1,000-foot observation tower that was going to be built next to Bayside Marketplace in downtown Miami.

Brickell church votes to sell waterfront land to developer for condo tower

An up to 80-story condo tower could rise on one of the few remaining waterfront lots in Brickell, after members of the church that owns the land voted to sell part of the parcel. The majority of First Miami Presbyterian Church members agreed to hammer out a deal with developer 13th Floor Investments for the parking lot as well as the elementary and middle…

City Of Miami To Build Patria Y Vida Condos, Sell Them At Cost

Miami Mayor Francis Suarez and City Commissioner Joe Carollo announced Monday that the city will develop a 104-unit condominium and sell off its units at cost. The city is seeking a builder for the project, dubbed Patria y Vida. A rendering of the Patria y Vida condos to be built by the city of Miami. Suarez said the project was spearheaded by Carollo, known for…

A Tight Market For Industrial Service Facilities Is About To Get Tighter And Investors Sense Opportunity

Everyone is becoming more accustomed to seeing small trucks roam their neighborhoods, delivering goods ordered online. But even as the coronavirus pandemic greatly intensified demand for these services, most municipalities are reluctant to approve proposals to develop new industrial service facilities where distributors and other businesses can store…

Swire Properties Inc. Sells EAST, Miami to Trinity and Certares

Swire Properties Inc., one of South Florida’s leading international developers, announced today that it has completed the sale of the 352-key EAST, Miami hotel to a joint venture among funds managed by Trinity Fund Advisors LLC, an affiliate of Trinity Real Estate Investments LLC (“Trinity”), and funds managed by Certares Real Estate Management LLC…

Music exec and songwriter buys Edgewater building in Opportunity Zone

Music label executive Carl Austin Rosen, whose hit song co-writing credits include rapper Post Malone’s “Rockstar,” paid $5.6 million for an Edgewater building at 235 Northeast 29 Street that could house his music studio. Rosen, who is founder and CEO of Electric Feel music management, purchased the vacant building through his Electric Feel Realty QOZB. Los Angeles-based…

Seagis Property Group buys warehouse near Miami Gardens for $8M

In a continuation of its South Florida industrial real estate shopping spree, Seagis Property Group scooped up a former manufacturing facility near Miami Gardens for $8 million. Seagis bought the 60,577-square-foot warehouse at 255 Northeast 181st Street from an affiliate of Intima, a wholesaler of bedding, according to broker Jonathan Salk of Vanguard…

CRE has biggest-ever sales quarter, surpasses pre-pandemic levels by 19%

The boom is largely fueled by investors snagging a large number of single properties in a multitude of deals, rather than previous booms featuring plentiful portfolio sales, or sales of entire companies. Investors purchased $193 billion in commercial real estate during the third quarter, marking a reported record that surpassed pre-pandemic spending by 19%.

PE firms LarrainVial, DaGrosa Capital invest in Miami real estate companies

Two financial firms acquired stakes in South Florida real estate companies as the region continues to attract significant investment. LarrainVial, a Chilean-based financial services firm, purchased a 33 percent stake in Black Salmon and TSG, a Coral Gables-based commercial real estate investment firm and developer, respectively, both led by managing partners Camilo…

Jet Aviation signs $120M Opa-Locka airport deal

An international private jet operator is setting up a base near Miami-Opa Locka Executive Airport in a deal valued at more than $120 million, The Real Deal has learned. Jet Aviation, led by President David Paddock and a subsidiary of publicly traded General Dynamics, signed a 40-year sublease at AVE Aviation & Commerce Center at…

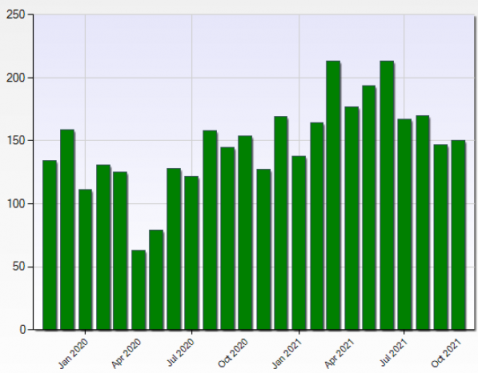

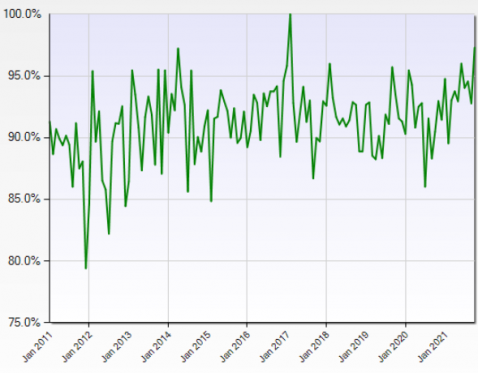

Miami Multifamily Report – Fall 2021

Miami’s rental market is overperforming in 2021, largely on the back of accelerated demand generated by incoming residents. Despite solid supply additions throughout the cycle, demand has maintained rent growth at some of the highest levels in the nation, with improvement at 2.8 percent on a trailing three-month basis. Meanwhile…

Windstar Cruises moving HQ to Doral from Seattle, tech firm inks Wynwood lease

Windstar Cruises I Doral Concourse Windstar Cruises will move its headquarters to Doral from Seattle, as South Florida remains a magnet for out-of-state companies. The cruise ship line inked a long-term, 9,100-square-foot lease at Doral Concourse, according to a news release from the landlord’s broker. Gordon Messinger of CBRE represented the building…

Expressway authority seeks 2,000 acres for Kendall Parkway

The Kendall Parkway corridor, a 14-mile multimodal transportation project with an estimated cost of over $1 billion, is in the planning reevaluation phase and awaiting funds as the Miami Dade Expressway Authority (MDX) fights in court its own existence. While the litigation is ongoing, no bonds can be issued, and the project can only move forward as funds…

Miami weighs plan to redevelop its Hyatt Regency site on river

Plans to improve and redevelop a long-standing Hyatt hotel site on the Miami River in downtown Miami have been proposed for years but never realized. That may change now that Hyatt intends to bring a new partner onboard. The fate of the high-profile property owned by the City of Miami is scheduled to be considered by the city commission today (10/28). On the…

93-story Waldorf Astoria of glass boxes wins Miami OK

A tower of glass boxes rising 93 stories on Biscayne Boulevard downtown as home to a Waldorf Astoria hotel has been recommended for approval by the city’s Urban Development Review Board. PMG Downtown Developers LP presented the elaborate plans. The site at the northwest corner of Biscayne Boulevard and Northeast Third Street, directly across…

Key Biscayne’s big victory in coastal risk areas

Key Biscayne’s inclusion in the Miami-Dade Beach Coastal Storm Risk Management project, headed by the US Army Corps of Engineers, to shore up the county’s vulnerable beachfront is a big win for the community, said Village Manager Steve Williamson. “A good percentage of our population, now grown to 15,000, lives on the coast,” he said, “all the while…”

Toll Brothers, CanAm Capital Get $103M loan for luxury student apartments at FIU

Swanky student housing is coming to Florida International University after Toll Brothers and CanAm Capital snagged a $103 million construction loan. The developers secured the loan from Ocean Bank on Monday to build Lapis, a 21-story luxury apartment building north of FIU at 765 SW 110th Avenue, according to a news release. It will have smart-electronic…

Developer buys OZ land in bet on Homestead as “future” of real estate

Many Miami developers covet waterfront sites and locations in bustling neighborhoods like downtown and Wynwood, but Armando Bravo is among those investing in south Miami-Dade. Bravo, through his Bravo and Partners 11 Acres LLC, bought an Opportunity Zone development site at 503 South Krome Avenue in Homestead for $5.4 million, he said. The 11 acres…

Wynwood nightlife pioneer sued over $1.5M in allegedly unpaid rent

The Wynwood nightlife pioneer who owned the popular Wood Tavern is being sued over $1.5 million in allegedly unpaid rent for four food and beverage establishments. The landlord, a joint venture led by New York-based Centurion Realty, recently filed three eviction lawsuits in Miami-Dade Circuit Court against Cesar Morales and two of…

New lease on life: Apartment projects popping up at distressed South Florida shopping centers

A rendering of Terra’s CentroCity development with David Martin of Terra Residential redevelopment of South Florida shopping centers is becoming more common, amid solid demand for rental housing and a slack market for retail space. This month, Houston-based developer Morgan Group won a land use change to build 356 apartments on the site of a former…

Landlords beware: Office tenants procrastinating on hybrid planning

A majority of office-using businesses are yet to decide what their hybrid future should look like. Hybrid work is underway in 72 percent of office-based companies and 65 percent said they don’t anticipate having any one dominant work location in the future, according to a new survey from Ernst & Young. A majority of business leaders believe a hybrid work…

Chart: Inflation Watch 2021 Intra-Quarter Update; Inflation Expectations Climbing

The 5-year TIPS spread, after almost calmly sitting a bit elevated over pre-pandemic levels, of a sudden spiked from its prior month close of 2.51% to 2.95% on October 25th. There has been much talk in the financial press of inflation pressures, but except for an initial move to the 2.5% range this has not registered in the TIPS. This may be but a blip itself, but of course…

This week on ‘Deconstruct’: The death of the cubicle

Are you a Marvel fan? Not the comics, of course, but the architect. You may be after this week’s episode of “Deconstruct,” TRD’s new podcast for all things real estate. Host Isabella Farr is joined by top architects Jonathan Marvel and Bernardo Fort-Brescia to talk about paradigm shifts in office space and where architecture firms fit in. With a portfolio showcasing…

The Importance of Commercial Building Permits

What’s lurking under the surface of your building? If work was done without commercial building permits, you could be in for an unfortunate surprise. You’ve found the perfect commercial property to invest in: it has the right number of office suites, the perfect amount of square footage, and plenty of parking spaces. It’s just what you’ve been looking for! But…

Video: PwC Real Estate Leader Byron Carlock Discusses PwC & ULI Emerging Trends in Real Estate 2022

In this video, the annual PwC – ULI (PricewaterhouseCoopers – Urban Land Institute) Emerging Trends Report, which is the result of surveying thousands of commercial real estate participants for their perspectives on the industry, is discussed with Byron Carlock, Real Estate Leader at PwC. Discussed are some of the most valuable takeaways from the report.

Active Miami construction lenderBank OZK loan originations reach highest level since 2017

Bank OZK, one of New York and Miami’s most active construction lenders, saw loan originations reach their highest levels in nearly four years. Arkansas-based Bank OZK’s Real Estate Specialties Group closed $2.21 billion of new loans during the third quarter, marking the highest quarterly level of originations since the fourth quarter of 2017. The bank also…

Miami River’s western bank poised for growth with $7M dev site purchase

Two Miami-based investors paid $6.5 million for a development site along the western bank of the Miami River, as growth along the river creeps inland. Andrew Korge’s Korgeous Development bought the nearly 2-acre industrial-marine property at 3007 Northwest South River Drive, with plans to eventually redevelop it, according to the deal’s broker. The property is…

Real estate powers Blackstone’s best quarter ever

Blackstone reported a blockbuster third-quarter this week — the best in its 36-year history. Earnings more than doubled year-over-year to $1.28 per share, trouncing the average Wall Street analyst estimate of 91 cents. And assets under management swelled 25 percent to $731 billion, besting industry records, said Stephen Schwarzman, the firm’s chairman…

One Thousand Museum doppelganger condo tower with helipad approved for Miami’s Edgewater

A partnership that includes the developers of One Thousand Museum have the green light to construct a 649-foot-tall waterfront condo tower in Edgewater with a helipad on the roof. Miami’s Urban Development Review Board approved the design of the proposed tower at 710 Northeast 29th Street by a vote of 3 to 1 on Wednesday. Called 729 Edge, it will be built…

Haute rent: What Gucci, Dior and others pay in Miami’s Design District

Shoppers keen on “revenge buying” this holiday season need look no further than Miami’s Design District, an 18-block cluster of luxury retailers, art galleries and restaurants. Gucci, Balenciaga and Dior Homme are just a few of the luxury outposts where shoppers can console themselves with fine threads for a healthy markup. A trio of developers and investors…

MMG Refinances Miami Gardens Shopping Center for $17M

MMG Equity Partners has secured $16.8 million to refinance Miami Gardens Shopping Center, located at 18350 NW 7th Avenue in Miami Gardens, FL. Guardian Life Insurance Company of America provided the loan for the shopping center. JLL Capital Markets team, which included Chris Drew, Brian Gaswirth, and Reid Carleton…

WeWork stock up on first day, but profitability still fuzzy

Two years after WeWork’s planned IPO imploded in spectacular fashion, the co-working company is now a publicly traded company on the New York Stock Exchange. The flex-office provider pitched itself to investors as WeWork 2.0. Gone were the hard-partying, pot-smoking days of founder Adam Neumann. No more self-interested side deals and pet projects…

Planned Waldorf Astoria Miami wins design approval

The Waldorf Astoria Hotel and Residences, planned for downtown Miami, won approval from Miami’s Urban Development Review Board on Wednesday. Property Markets Group, led by Kevin Maloney, Ryan Shear and Dan Kaplan, is proposing to construct a tower at 300 South Biscayne Boulevard that is 1,049 feet tall. The 100-story Waldorf Astoria in Miami…

Mall operator Washington Prime Group back from bankruptcy; CEO out

Just a few months after filing for Chapter 11, mall operator Washington Prime Group has emerged from bankruptcy. When the real estate investment trust, which owns more than 100 malls across the country, filed for bankruptcy protection in June, it listed $4 billion in assets and $3.5 billion in debts. Through the process, the company has reduced its debt…

Miami board rejects design for massive Wynwood mixed-use project, N29

It looks like it is back to the drawing board for the developers of a massive, nearly 1 million-square-foot, mixed-use project in Miami’s Wynwood. L&L Holding Company and Carpe Real Estate Partners were dealt a setback on Wednesday, when the Miami Urban Development Review Board voted 4 to 0 to reject its proposed design for N29, an office, retail, and apartment…

Miracle Mile double play: Terranova pays $8M for two Coral Gables retail sites

Stephen Bittel’s commercial real estate firm made a double play in Coral Gables, acquiring two Miracle Mile storefronts for $7.8 million. An entity tied to Miami Beach-based Terranova Corporation bought the retail sites at 232 Coral Way and 330 Miracle Mile, records show. The seller is Will of Mildred W Brown, LLC. In a statement, Bittel said the firm now owns…

Why Miami is a Magnet for Multifamily Developers, Lenders

South Florida’s multifamily market continued its expansion—bolstered by in-migration from major metros and a business-friendly climate—throughout the health crisis. What’s more, private capital investors are cashing in, banks are closing on sizable construction loans and rental rates are on the rise. Lending and development power players in the area…

Investment duo pays $41M for Fort Lauderdale shopping plaza

Steven Hudson and Charles Ladd Jr. are not slowing down their Broward County retail shopping spree, as they scooped up the South Harbor Plaza in Fort Lauderdale for $40.5 million. The real estate honchos, through their Chapter Two Investments, along with co-investors Las Olas Capital Advisors and Foreward Management, bought the retail-office property…

Palm Beach Gardens shopping center fetches record $102M

The Legacy Place shopping center traded for $101.7 million, marking the biggest Palm Beach County retail deal this year. Yet, the plaza also traded at a loss of nearly 44 percent compared to its last price in 2007. A joint venture of private equity mammoth Lone Star Funds and retail investor Woolbright Development bought the property…

TA Realty sells Palm Beach Gardens office building for $17M

Real estate investment behemoth TA Realty sold the Merrill Lynch-anchored Gardens Pointe for $16.8 million. Sunnyfield South bought the property at 3507 Kyoto Gardens Drive in Palm Beach Gardens, according to a release from one of the brokers. Sunnyfield South is affiliated with Fort Lauderdale-based Levy Realty Advisors and also is managed by…

In good hands: Allstate reels in $12M for office-retail plaza in West Palm Beach

Allstate Investments cashed out of a West Palm Beach retail and office center it acquired nearly 30 years ago. The Northbrook, Illinois-based national asset management firm, which falls under the Allstate Corporation umbrella, sold the two-story Palm Gate Plaza at 3899 North Haverhill Road for $12.4 million, according to records. The buyer is an affiliate of…