Greg Mirmelli picks up Collins Avenue property after flipping nearby building

Miami Beach investor Greg Mirmelli purchased a retail property on Collins Avenue that he eventually hopes to redevelop into a high-end residential project, The Real Deal has learned. Mirmelli said he paid about $6.5 million for the building at 600 Collins Avenue in South Beach. The acquisition follows his sale of 800 Collins Avenue in November for $6.2 million.

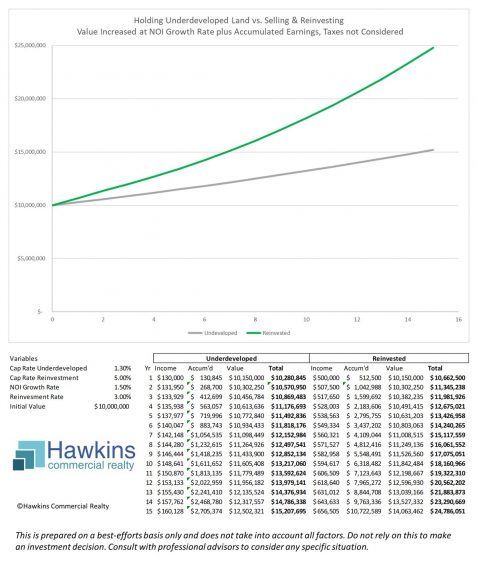

Miami Near Top of List of Top 10 Multifamily Markets by Units Delivered in 2021

Multifamily development had an exceptional year in 2021, with more than 350,000 units delivered nationally. The volume was boosted in part by the projects initially slated to come online in 2020 and delayed by the onset of the pandemic, but mainly by mobility and job recovery-induced demand. Lingering concerns about overbuilding have largely dissipated thanks…

WeWork partners on flex space availability

CEO Sandeep Mathrani is putting the “we” in WeWork in a strategic partnership with a flex workplace startup aimed at expanding the company’s global reach. WeWork is joining forces with office space marketplace Upflex to provide increased access to coworking spaces, according to an SEC filing. Financial terms of the arrangement were…

Chicago investor flips Miami Shores Walgreens for $8M

A Chicago investor rang up an $8.2 million sale of a Miami Shores Walgreens to a Torrance, California-based real estate investment firm. An entity managed by Steven Swanson II, managing partner at Chicago-based Swanson Development Group, sold the 15,206-square-foot retail store at 9020 Biscayne Boulevard to an affiliate of Bison Asset Management…

Fifield Breaks Ground on 266-Unit Avida Aventura Apartments in Miami

Fifield Cos. has broken ground on Avida Aventura, a 266-unit apartment project in Miami. The construction timeline and development costs were not disclosed. The eight-story property will offer studio, one-, two- and three-bedroom floorplans ranging from 470 to 1,400 square feet. Each unit will include a balcony. Community amenities will include a…

CRE brokers adapt to brave new Miami market

Tony Arellano remembers the days when inking a lease took months. Getting a tenant to commit to space involved fielding more than a dozen inquiries, just as many in-person meetings, and countless back-and-forths on pricing and terms. That was before Silicon Valley’s tech companies, as well as California and New York’s venture capitalists and hedge…

“We kicked the crap out of ‘21”: Largest U.S. mall owner claims comeback

Despite being the nation’s largest mall owner, CEO David Simon has repeatedly claimed that Simon Property Group is more than just “a mall company.” Some of the REIT’s latest moves, detailed on its quarterly earnings call Monday, suggest he may be right. SPG is redeveloping five of its mall locations. The Phipps Plaza in Atlanta will soon be joined…

Easton and LBA Logistics buy Hialeah industrial development site for $29M

A joint venture between Easton Group and LBA Logistics dropped $29.4 million for an industrial development site in Hialeah, marking the partners’ latest project in Miami-Dade County. The partnership bought a 26.4-acre vacant property used as a truck yard at 4220 West 91st Place in Hialeah, according to a press release. Easton Group and LBA paid about $1.1…

CRE foreign investment roared back in 2021— with a few focus shifts

Foreign investors were boxed out of the American commercial real estate market for much of 2020, but they roared back for the sector’s record-breaking 2021. Overseas investors bought $70.8 billion of commercial real estate last year, according to data from Real Capital Analytics reported by the Wall Street Journal. The total almost doubled from 2020 and…

Miami International Boat Show sales forecast: $1.3 billion

The 2022 Discover Boating Miami International Boat Show is expected to generate $1.34 billion in sales as the boating industry has gained due to a covid-generated demand increase for outdoor activities. Florida far and away leads the nation each year in boat sales revenues. The Feb. 16-20 Miami International Boat Show, the world’s largest boat and yacht…

Golden Glades park & ride transit hub nears opening

The $60 million Golden Glades Park & Ride begun in December 2018 is to be ready within weeks, connecting with state roads 7 and 9/Northwest Seventh Avenue and leading to I-95 Express lanes. The hub accesses Tri-Rail and buses. The Florida Department of Transportation developed it in coordination with Miami-Dade County, which is to operate and…

Micro housing becoming big answer to affordable living

Micro housing units are popping out in South Florida to tackle the dilemma of affordable housing while living in the most popular neighborhoods. Developers are bidding in the trend as it is becoming successful. In areas such as Hialeah, Coconut Grove, Miami Beach and Brickell, where the price of renting regular-sized apartments is increasing, housing…

Miami Beach readies four city-owned sites for sale

The City of Miami Beach is preparing four city-owned properties for their potential sale to finance various unfunded capital improvement projects. Two city-owned vacant lots have been removed from the list that included five properties and the North Shore Branch Library, located at 7505 Collins Avenue., that could be sold by the city. An 8,700-square-foot lot…

Multifamily developments in pipeline could take years to finish

Feeding into a record-breaking in demand real estate market, multifamily developers have enough work in the pipeline to last into 2024. With a tremendous amount of backlog, demand for multifamily development will not diminish any time soon, said Al Fernandez, president for ANF Group, a firm providing construction management in commercial, multi-family…

Landmark JV to Renovate Student Housing Community in Miami

A joint venture of Landmark Properties, Peninsula U.S. Real Estate and W5 Group has revealed plans to renovate and add townhome units to The Cloisters, a 71-unit community near the University of Miami. The project will break ground this summer, with completion slated for fall 2023. Landmark Properties acquired the asset for $23.3 million from…

Talks advance for vertical Miami International Airport cargo hub

A county committee voted Tuesday to let Mayor Daniella Levine Cava directly negotiate creation of a unique vertical cargo mega-hub at Miami International Airport, which is nearly at cargo capacity. The Airports and Economic Development Committee proposal now heads to a full commission vote. The committee agreed with the mayor’s aim…

If county’s workforce grows, prepare for an economic spurt

Will workers flock to the job market as the Omicron wave ebbs? That’s not an academic question. It’s a key to filling huge labor gaps that have eaten holes in our economy. Large numbers of South Florida employers complain they can’t find enough workers to fill orders and serve customers, or that they’re holding on only by overtaxing depleted staff and paying…

Downtown Doral development thrives

Spearheaded by community developers Codina Partners, the economic impact of Downtown Doral has created its share of growth. During a time where many other commercial operators in South Florida were finding ways to survive, the 250-acre mixed-use community that is Downtown Doral managed to thrive throughout the pandemic, said Ana Marie…

Industrial spec development up, delivery down

Developers across the country are racing to build new warehouses, as vacancy rates approach sub-1 percent in some markets. The only problem? Many can’t actually finish them in a timely manner, due to supply chain issues and labor shortages. Deliveries of speculative construction industrial warehouses larger than 100,000 square feet dropped significantly in…

Bloom Hotels picks up Sixty Sixty condo-hotel in Miami Beach for $24M

Bloom Hotels’ David Harari, Sagar Desai and Intega’s Victor Ballestas with 6060 Indian Creek Drive: The Sixty Sixty condo-hotel in Miami Beach, once the subject of a fierce foreclosure battle, traded hands for $23.5 million to a buyer that plans to renovate and possibly expand the property, The Real Deal has learned. Integra Investments and Sagar Desai’s Activate…

Aircraft firm opening new US HQ at 830 Brickell, Trader Joe’s-anchored Miami Beach building inks deals, & other leasing news

Miami Dublin-based AerCap, a commercial aircraft owner and lessor, will open its first U.S. headquarters at 830 Brickell. AerCap leased the entire 50th floor at the 55-story tower under construction, according to a news release from the project’s developers and leasing brokerage. AerCap will have 50 employees in 20,000 square feet…

Dan Kodsi and partner buy site north of downtown Miami for apartment development

Developers Dan Kodsi and Rafael Pecchio paid $8.9 million for a property in the Arts & Entertainment District where they plan a 200-unit apartment tower, The Real Deal has learned. Kodsi’s Elevate 13 Street Holdings acquired the 18,000-square-foot site at 1317 and 1345 North Miami Avenue from ABC Group, the owner of the restaurant supply store…

Amazon doubled its real estate holdings in 2021

Amazon literally doubled down on owning real estate last year. The e-commerce giant finished 2021 with twice as much of its own warehouse, distribution and data center space as it began the year. The buying spree brought its owned real estate portfolio to 16.7 million square feet across North America, according to an annual financial report, up from 8.5…

Treo Group nabs former Florida City RV park for redevelopment

Treo Group bought a former mobile home park in southwest Miami-Dade for $6.8 million, with plans to build a mixed-use project. Miami-based Treo, led by principals Otto Boudet-Murias, Rolando Delgado, Eduardo Garcia and Carlos Ortega, acquired the Florida City Campsite & RV Park at 601 Northwest Third Avenue in Florida City, according to the brokers…

Thinking inside the box: Developers rush to create more warehouse space

If anyone believes demand for industrial real estate is cooling, brokers, developers and investors in the sector would say they’re dead wrong. With vacancy rates approaching zero percent in some markets, catapulting asking rents and sparking bidding wars for leases, the sector’s emergence as the hottest commercial asset class continues. “This is not a market…”

The Fed: Has consumption spending on services recovered?

After COVID-19 induced a recession, the FRED Blog discussed the consequent drop in spending on services caused by mandated social distancing. This decreased demand for services (i.e., work done on one’s behalf) was partially offset by an increased demand for goods. Today, we revisit the topic to gauge the recovery in consumption spending…

North Miami Beach investor acquires Lauderhill apartments for $13M

Treevita Capital’s chief executive director Hugo Cascavita and the Victoria at Lauderhill apartment complex at 2011-2051 Northwest 43rd Terrace in Lauderhill: A North Miami Beach-based real estate investment firm bought a garden-style apartment complex in Lauderhill for $12.8 million. An affiliate of Treevita bought the 88-unit Victoria at Lauderhill Apartments…

OKO Group, Cain International Land Miami Tower Tenant

AerCap, one of the world’s largest aircraft leasing companies, has signed a 20,000-square-foot lease at 830 Brickell, a skyscraper taking shape in the heart of Miami’s financial district. The company’s new headquarters will occupy the entire 50th floor of the 55-story building, the South Florida Business Journal first reported. Developed by a partnership…

Inside mall scavenger Kohan’s shopping spree for declining shopping centers

The majority of its storefronts are dark and its previous owner, CBL & Associates, filed for Chapter 11 bankruptcy in November 2020. So when New York-based Kohan Retail Investment Group landed half of the Burnsville Center property at auction for about $17 million — a fraction of the $64.2 million of outstanding debt on the property — the city had…

Hot boxes: Where industrial rents have soared the most

If you’re in the market for warehouse space, get in line — and get ready to pony up. Data released this week by Savills shows the U.S. industrial real estate market lives up to the hype. It is crowded and expensive. Asking rents were up 8 percent last year nationally, and that includes less trafficked locales in flyover country. Increases varied widely. In…

From ‘The Butt End Of Real Estate’ To Blind Bidding Wars: Inside The Staggering Rise Of Industrial

When Rooney Daschbach started working warehouses in 1986, finding tenants was a struggle. He would advertise teaser rates of 25 cents a square foot for the South Bay Los Angeles properties he was marketing, sending out rate cards illustrated with pictures of quarters. To woo tenant reps, he and colleagues would offer free weeklong vacations to Hawaii, even…

PMG, E11even Partners score $149M construction loan for downtown Miami condo development

The developers of E11even Hotel & Residences in Miami scored nearly $150 million in construction financing for the first condo tower. At the same time, they sold land amongst each other, as the two-building project continues to move forward. A Starwood Property Trust affiliate provided the $148.5 million construction loan to the developers, a partnership…

Top 10 development projects in Miami-Dade in 2021

The following is a preview of one of the hundreds of data sets that will be available on TRD Pro — the one-stop real estate terminal that provides all the data and market information you need. The biggest development in Miami-Dade County by any measure is the massive Grove Central project going up next to the Coconut Grove Metrorail Station in Miami. Terra…

Thorofare Capital Provides $16M in Financing for Downtown Miami Development Site

Thorofare Capital, Inc., an affiliate of investment manager Callodine Group, has provided $16.3 million in financing to Moishe Mana, CEO of Mana Common, for the re-development of 129, 133-139 and 141 East Flagler Street properties in Miami, FL. The total assemblage consists of three properties, including the historic Shoreland Arcade building, totaling 89,533…

Interest Rate Hikes Expected To Barely Dent Hot South Florida Market

It’s widely expected that the Federal Reserve will raise interest rates this year — possibly at each of its seven meetings, as Bank of America predicts. But South Florida commercial real estate experts don’t expect that to slow down the booming market. Jose A. Rodriguez, a real estate attorney and partner at Miami-based law firm Rennert Vogel Mandler & Rodriguez…

Vote Delayed On Related Group’s Controversial Condo Project

At the end of a meeting that lasted from 5 p.m. Wednesday to 3 a.m. Thursday, city commissioners in Hollywood, Florida, delayed a vote on whether to allow Florida’s most prominent condo developer to build a 30-story condominium on part of a taxpayer-owned, beachfront site that now includes a public park. Commissioners are now scheduled to vote on…

AMAC seals $7M deal for Hollywood multifamily development site

AMAC closed a $6.6 million deal for a Hollywood development site and is partnering with Miami-based ROVR Development to build a 180-unit apartment project. An affiliate of New York-based AMAC, founded by Maurice and Ivan Kaufman, bought the 2.2-acre property at 4465 Griffin Road, according to records. The seller is an affiliate of PrivCap…

Fueling faith? Pembroke Pines church will share its property to make way for a Wawa

A church in Pembroke Pines plans to share its 5-acre property on busy Pines Boulevard with a Wawa gas station and convenience store. The Wawa would replace the existing Trinity Lutheran Church and its parking lot at 7150 Pines Boulevard, and the church would move to a new home on the south side of its property, which is vacant. Pembroke Pines…

Prologis sells Pompano Business Park for $239M in record deal

Equus Capital Partners bought the Pompano Business Park for $239.2 million, a record deal that surpasses the biggest industrial sale of 2021. The deal is part of Equus Capital Partners’ purchase of a 5.4 million-square-foot nationwide portfolio for a reported $930 million from industry giant Prologis. In the Pompano Beach deal, Newtown Square, Pennsylvania…

Coral Springs investor picks up Plantation office building for $13M

A German real estate firm cashed out of a Broward office building for $12.7 million. An affiliate of Rüger Holding sold Plantation Corporate Center at 2 University Drive in Plantation, according to the brokers involved in the deal. The buyer is MMB Commercial Properties Company, a Coral Springs firm managed by Radomir Penjevic, according to corporate records.

Asana buys The Hive, Flagler Uptown in downtown Fort Lauderdale for $18M

Asana Partners made a play on downtown Fort Lauderdale’s Flagler Village district, paying $18.3 million for nearly fully leased retail and office properties. Charlotte, North Carolina-based Asana bought The Hive at 900-924 North Flagler Drive and Flagler Uptown at 723-737 Northeast Second Avenue, according to…

Publix-anchored Delray Square sells for $48M

Jacksonville-based Sleiman Enterprises bought the Publix-anchored Delray Square shopping plaza for $48 million, marking continued appetite for retail centers with grocers. Records show an affiliate of The Keith Corporation, based in Charlotte, North Carolina, sold the 162,412-square-foot, multi-building property…

Equus Capital buys West Palm warehouses for $41M

Equus Capital Partners paid $41 million for three West Palm Beach warehouses. The deal is part of a 5.4 million-square-foot nationwide industrial portfolio that Equus Capital bought for a reported $930 million from Prologis, which included a $239 million purchase in Pompano Beach earlier this month. Equus Capital Partners…

Blackstone sells waterfront assisted living facility in Jupiter at a loss for $41M

Blackstone sold the waterfront Mangrove Bay assisted living facility in Jupiter for $41.2 million, a significant loss in value from its purchase price five years ago. Chicago-based Ventas, a real estate investment trust, bought the 155-unit property at 110 Mangrove Bay Way from a Blackstone affiliate, according to records. The 190,348-square-foot facility was constructed…