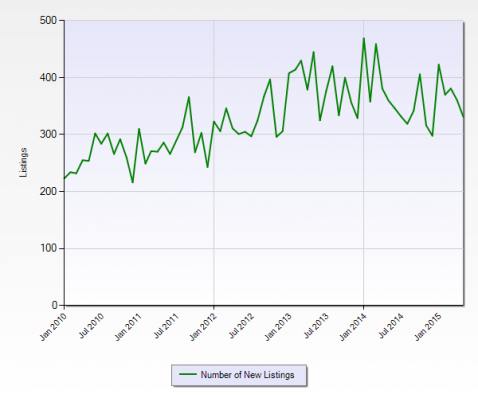

New Commercial/Industrial Improved Listings Miami-Dade MLS

As can be seen in the above chart, new commercial/industrial (improved) listings in MLS for Miami-Dade County have fluctuated in a range of 300 to 450. This follows, in the years preceding, a period in which but for a bump in the 3rd quarter of 2011 the quantities of new listings for this category were bound in a lower 220 to 300 range.

In the most recent month, May 2015, new improved commercial/industrial listings for Miami-Dade dropped off to 331, as also can be seen in the above, in the lower end of this band. Further, this is after toying with the lower end of this range in August, November, and December, with 319, 316, and 298 new such listings, respectively.

What gives?

The market has been strong (view trends: industrial; multifamily; office; retail), which one would expect would coax sellers out of the woodwork, resulting in increased sales. This seems likely the impetus for the move to a new range for newly listed properties in January 2012. As strength continued, however, investors have become ever more comfortable with their lot. Further, more of their equity becomes “the house’s money,” i.e. profits, which investors tend to take more risks with, an effect that rings true, intuitively, and that was first described by Richard H. Thaler and Eric J. Johnson of the Johnson Graduate School of Management of Cornell University.