We regularly work with buyers to make unsolicited offers for commercial real estate, usually in situations where a property is not optimally utilized, if utilized at all, i.e. where the current use is not the property’s highest and best use. Owners of these properties frequently would sell for a premium price, and my buyers frequently will pay more than market value. That feels like a match.

But then…

Market value is notoriously tough to pin down on commercial properties. Consequently, in the absence of a genuine concept for market value an unsolicited offer to an owner instead becomes an appraisal. Thus, a property that is really worth $2 million on which an owner receives an offer for $2.3 million is worth, to an owner, $2.3 million. Most commercial owners have no real need to sell and owners of properties not on the market don’t typically want to sell. Given this, in the face of a new “appraisal” – in the form of the offer just received – they’ll internally register a lack of desire to sell at market value. Thus, in the process of making an offer, market value is established in the mind of an owner by the unsolicited offer received. Ugh.

This happens frequently. I have developed techniques over time to mitigate the effect, but overcoming it is nonetheless an ongoing challenge. Commercial property investors are a confident lot, so much so in their opinions that they’ve put their money where their mouth was by investing in a non-liquid asset. Thus, once they have opinions, even where developed so casually, it can be a challenge to get them to change them.

There are two counterpoints to the “why would I sell at market value” objection:

Highest and best use values may not exist in perpetuity. They can be challenged by developed property pricing, by a property being penned in by surrounding development, and by missed opportunities with premium specific purpose buyers.

When a property is considered for redevelopment, it generally is trading at land value. That is a good thing for a seller. Higher and better use values are like a jackpot for an owner of a property otherwise becoming less viable over time. Land values are volatile, however, as they essentially represent a call option on the difference between the cost of developing the land, with the value of the land (the option, if you will) a function of the spread between the market value of developed property and developed cost. When the market rolls over, this intrinsic value can drop precipitously, even go negative, at which point the land value is low as it is nothing more than an option on anticipated future intrinsic value (market value of developed property and developed cost). Also, a use today may be obsolete tomorrow; gas stations as electric cars become more prevalent would seem to be one we’ll be witnessing in the coming years.

As one of many examples, I presented an offer for an old multifamily property that was clearly nearly double what the property was worth as a multifamily property. This was for a developer interested in the land and how it would fit into its large development adjacent to that multifamily property. The development will happen, after which there will be no interest in the land by another, thus the property will just be worth its value as a multifamily property, about half what my buyer offered. This was an incalcitrant family, surely thinking my buyer and I were out to get his property on the cheap. I can imagine conversations amongst the family discussing about this offer and how well the investment in the property has performed, congratulating each other on the wisdom of not selling. The reality is that it will take a long time, perhaps decades, for the nominal value to inflate to the price offered, and the inflation adjusted value many not do so in that seller’s grandchildren’s lives. I see this happen all the time, though this was one of the more extreme ones.

Foregone Monetization

If you have a vacant piece of land with a market value of $5 million, you likely have a piece of land that could be monetized for around $250,000 a year. The reason your land has the value it does is because of this potential monetization. Additionally, in most cases, the highest and best use of the land has peaked, and is not going to get better. Thus, by keeping the land vacant, you are only forgoing the income that the property could be garnering, income you could be earning if you sold the property and purchased one already generating income.

This adds up over time.

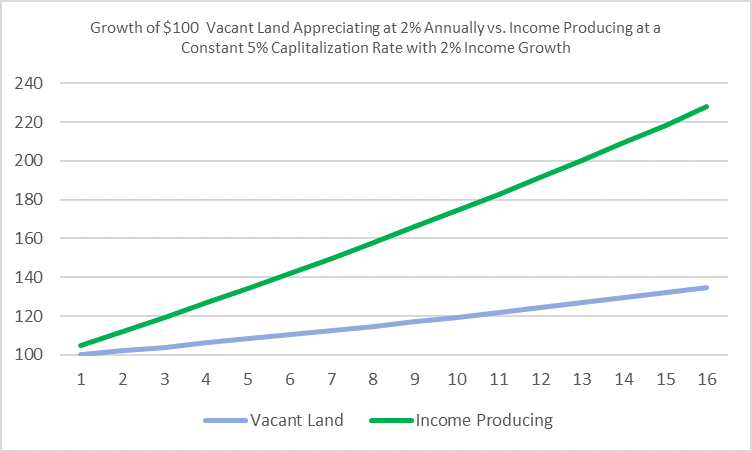

The chart above consider $100 of income producing property at a 5% constant capitalization rate with 2% net operating income growth versus the same $100 in vacant land appreciating at 2%, in line with growth in its monetization potential (potential net operating income) growth, and with no net income.

Consider $5 million of income producing property at a 5% cap rate with 2% rent growth and assuming market value at a future date also at a 5% cap rate. Alternatively, consider $5 million of vacant land appreciating at 2% with no net income. The investor with vacant land will have more value later, and will likely be very proud of his fine investment, but look at what has been forgone over time.

This isn’t the whole story. Sometimes there is the potential for a rapid change in the potential use of a property, particularly if a property is near a central business district. Also, vacant land doesn’t have zero income, it usually has either a net carrying cost, principally property taxes, or a small net operating income from pylon signage or other partial monetization. Also, in this chart above, I’ve not taken into account earnings from reinvestment of net operating income, which would make vacant land look even less appealing to hold on a relative basis.

For properties near the central business district, highest and best use can improve fairly dramatically. Years back, I recall numbers of two story multifamily properties surrounding a popular happy hour spot I frequented, The Firehouse. Today, most of those properties have been scraped to make way for high rise developments, and those that haven’t surely will be. That area changed rapidly. I see that as the exception, however, as most properties are nowhere near downtown.

Then There’s Thanksgiving Dinner

When one has owned something for a long time, there is a built in gain that brings with it genius cred. When the line at Thanksgiving Dinner is “you really called it with that purchase,” it becomes one’s identity. Sell it, and that will fade away, just blend into a balance sheet somewhere. Though it is a smarter move to sell, reinvest, and accumulate income, it is nowhere near as sexy as “X times what you paid for it.” In my dealings, I’ve come to believe that this is a factor, at least subconsciously, in the decision making process of many owners.

God Forbid Don’t Let Me Be the Sucker!

Finally, there is the strong motivation not to be the sucker that sold for less than what something became worth later. The easy way to avoid that is to always agree to sell for well over market value. That is, unless someone wants to pay that elevated price. If that happens, then as mentioned above, market value is perceived as equal to that offer, and the asking price can again be elevated. Problem solved.