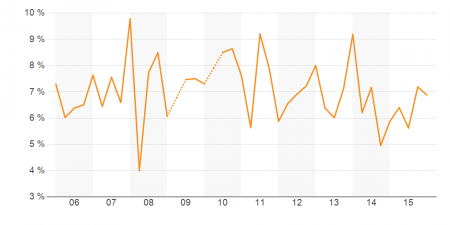

Cap Rate for Multifamily Properties with 20 to 80 Units in Miami-Dade County for the 10 Years Ending 2015

The capitalization rate (cap rate) for mid-market multifamily properties in Miami-Dade County (20 to 80 units, 1,448 properties) drifted to just under 7% in the most recent period reported by Costar. As can be seen in the attached chart, cap rates have been relatively consistent over the years, generally moving up and down around a 6.5% or so midpoint.

In recent years, increases in rent and declines in vacancy, combined with stable cap rates, have led to considerably higher prices on many area multifamily properties. Investors for the most part, however, remain comfortable with their multifamily holdings, as although supply has been increasing and the threat of a global economic slowdown looms, no imminent threat to rental or vacancy rates is evident, and investment alternatives are perceived as slim.

Chart courtesy of Costar.