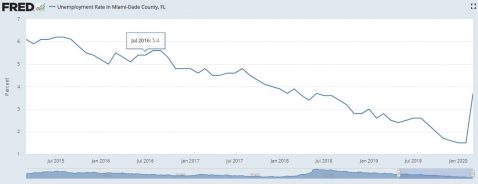

As can be seen in the accompanying chart, after years of steady decline, the unemployment rate spiked notably in March of 2020. This surely is caused by the earlier stages of the COVID-19 Pandemics, and thus will likely be even higher in April.

Higher unemployment is bad for the economy, and in turn for commercial real estate. Occupancy rates and rent growth expectations tend to decline as collection issues increase, bad for commercial property income statements and valuations. Of course, in this case, what remains to be seen is how temporary this shock will be, and to what extent income and values will be affected, if at all.