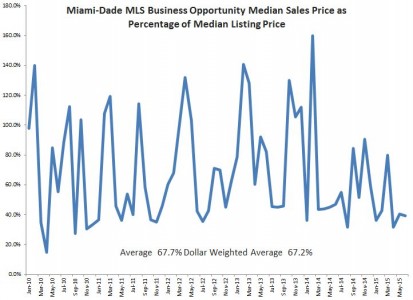

In the 5 1/2 years from January 2010 through June of 2015, the median sales price for businesses sold and recorded in MLS (business opportunity listings) was less than the median asking price for the same month 77.2% of the time. Given that this data is simply for new listings or sales in a given month, the percentage varies dramatically, as the businesses sold are almost entirely different than the businesses listed in given months.

In the 5 1/2 years from January 2010 through June of 2015, the median sales price for businesses sold and recorded in MLS (business opportunity listings) was less than the median asking price for the same month 77.2% of the time. Given that this data is simply for new listings or sales in a given month, the percentage varies dramatically, as the businesses sold are almost entirely different than the businesses listed in given months.

In the 5 1/2 years considered, the average selling price was 67.7% of the average asking price. The sum of the median sales prices as a percentage of the sum of the median listing prices, i.e. a dollar weighted average percentage, is a similar 67.2%.

What can be made of this? Perhaps little. On the surface, it appears that on average businesses listed sell for about 1/3 less than the asking price. However, this is far from the complete story. Within this category there may be highly unreasonably priced listings. Further, one must consider that the listings are, by definition, entered, but of the businesses listed only the ones that later sell (and have the sale recorded in MLS) will count as completed sales to thus effect the median sales price for a given month.

When you combine all this, the result is a compromised data set. Make of it what you will. Experience tells us that good businesses priced right attract real buyers that pay a fair price, further making the concept of a significant discount to the asking price less credible.