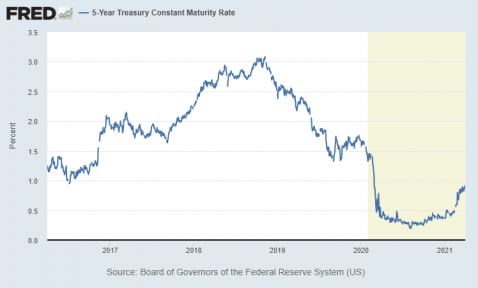

Yields on 5-year U.S. Treasury Notes edged up to 0.92% by the end of March. This is low, to be sure, but up from the barely-keeping-its-head-above-naught 0.36% yield booked at the prior year’s end. This yield is considered to most closely track commercial real estate financing cost, and those are of particular interest to investors in commercial property.

This cheap money environment continues to be a powerful force on commercial real estate prices. There are of course ongoing concerns about what follows from here, but that is unknown. What is known for sure is that lower interest rates means lower debt service. Also, real estate income becomes relatively more attractive to fixed income investments.

The interest rate environment has the ability to affect commercial real estate values in a number of different ways. Borrowing cost, i.e. debt service, is of course affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time, but not always in the short term, in line with interest rates, with considered analyses generally concluding that cap rates move on average in the same direction as 10-year rates, but by about a third as much. Interest rates also affect the economy, which in turn affects vacancy and rental rates.

Also see:

- Chart: TIPS Spread Indicating Highest Inflation Expectations in 13 Years

- All “Borrowing Cost Quarterly” Posts