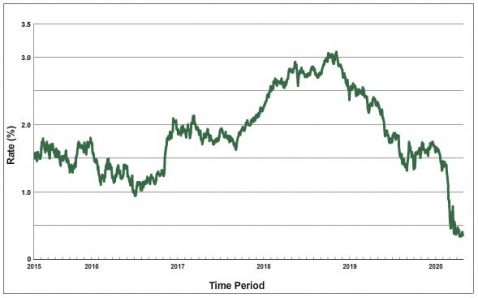

At the end of April of 2019, intermediate yields remain at lows reached in recent weeks. This has, of course, been driven by reduced economic activity due to the COVID-19 pandemic. As can be seen in the accompanying chart, five year rates, which are most closely tracked for commercial property borrowing cost, found themselves under 0.5%, flirting with negative rates. Though this would generally bode well for borrowing costs, at the moment things are so locked up it is a matter of being excited about rates at which you can’t borrow. But, that will pass…

This low rate environment is powerful for real estate as an asset class. There are reasonable concerns about occupancy rates in a slower economy, but lower rates, by way of cost of capital and as an alternative asset class comparison, will have an offsetting positive effect. How this battle will play out remains to be seen.

The interest rate environment has the ability to affect commercial property economics in a number of different ways (see this, this, and this). Borrowing costs are, of course, affected directly, as higher interest rates increase the cost of borrowing and thus negatively affecting demand. Cap rates tend move over time with interest rates, but not in lockstep, with considered analyses generally concluding that capitalization rates on average move in the same direction as 10-year rates, but only about a third as much, and again not in lockstep. Interest rates also affect the economy, which in turn affects vacancy and rental rates.