I considered setting up a new topic category for this called “duh.” Chuckle.

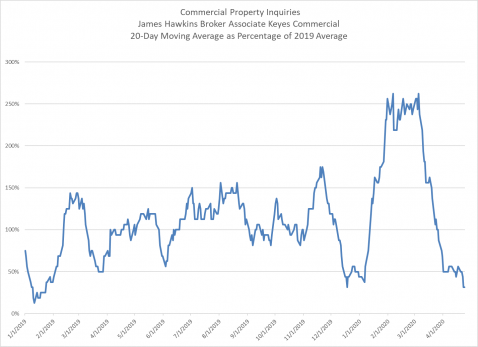

If you know me, you know I’m a bit of a data hound. I collect and manipulate data as a tool. One set of data I maintain is various types of selling activity, which I log throughout each day. It isn’t perfect, but I’d say it is consistently imperfect, and thus good enough to compare one period versus another. In general, I utilize this data for goal setting, assigning points to various metrics so as to weight different activities for business contribution. Given a noticeable change in activity with COVID-19, I thought it might be interesting to look at commercial property inquiry trends.

The chart above shows the 20-day moving average of new commercial property inquiries. This is the sum of various kinds of new inquiries, which in actuality I track more specifically. The year had started off with a bang, as can be seen, which is more a culmination of my efforts over time than a statement of market conditions. Once coronavirus hit, however, this metric went into a dive, with the 20-day average now about 10% of what it was pre-COVID.

Willikers.

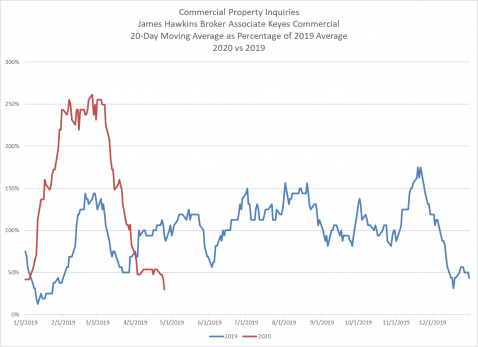

This second chart considers the same data, but plotting 2020 versus 2019. There had been a early part of the year surge in 2019, as well, but 2020 was running about 70% higher than 2019. Again, I would guess that this is all specific to me, as, speaking anecdotally, I’d say the market environment versus the prior year was similar, if not a touch muted. Also standing out here is the drop in activity during the holiday season. Bah humbug.

Keep in mind these are all 20-day moving average numbers. Thus, that last dip in the red line for 2020 represents 20 days of low inquiries.

What does this mean? As this very moment, it likely doesn’t mean much. This pandemic hit so quickly, everyone is just stunned. Market participants are trying to make sense of it all. I can tell you anecdotally there are buyers circling, purporting to be interested in snapping up properties at depressed prices. Meanwhile, sellers almost universally seem to be in a wait-and-see mode, generally in no rush to sell barring necessity.

One last point. There is a notable surge in such activity as the new year begins. There are likely multiple reasons for this, but one of the principal ones surely is pent-up interest during the holiday season. This begs the question of whether there will be a surge as we exit this pandemic environment. It seems safe to assume there will be some post-pandemic increase in inquires. How much of a surge there will be is more the question.