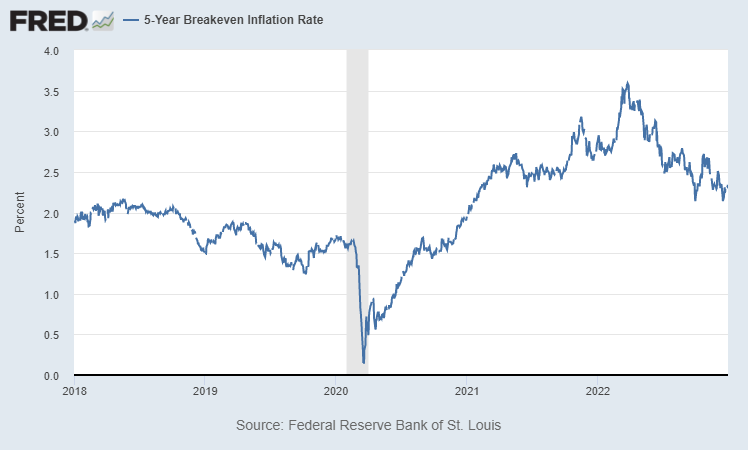

The chart above is of the 5-Year breakeven inflation rate, commonly referred to as the TIPS spread, for the five year period ending on December 30, 2022, the last trading day of 2022. This illustrates the difference in the yields, i.e. the spread, between United States Treasury bonds and Treasury Inflation-Protected Securities (TIPS) of the same maturity. This is a useful and oft-quoted measure of expectations for (CPI) inflation in the financial markets. The spread indicates expected inflation, of interest to investors in commercial real estate – more on that below – and for that matter investors of all kinds.

As one can see in these charts, the 5-year TIPS spread hit a high in March, 2022 at 3.59%. As the Fed has maneuvered aggressively to tap inflation down, this has now pulled back to its year end 2022 level of 2.33%, which would be markedly down from the actual inflation of 7.1%, as measured by the CPI, in the year ending November 2022. This indicates that financial markets are confident that inflation is coming down, that the Fed is “on it” and will get the job done, likely sooner rather than later given that five year expectation level as compared to recently inflation readings. Investors are putting their money on a bet that inflation it going to be at this 2.33% level on average for the next five years. This indication may be wrong, of course; traders lose money – cough FTX – all the time, after all. The relevance here is that numbers paying close attention and that are putting their money on the line believe inflation is going to subside.

“I don’t mind going back to daylight saving time. With inflation, the hour will be the only thing I’ve saved all year.”

~Victor Borge

Not Just Opinions, Real Money is on the Line

Real money is at stake with these spreads. TIPS pay interest every six months, based on a fixed rate that is calculated by multiplying the adjusted principal by one-half the calculated interest rate (i.e. half a year’s worth of inflation at that rate). Thus, a “bet” that an investor makes in with these bonds has real financial implications. If actual inflation is higher than priced in the markets, a TIPS buyer will make more that a straight treasury buyer. If it is lower, that TIPS buyer will make less. How much money is at stake? In 2017 Morningstar pegged the market at $1.2 trillion. Thus, every 1/10% difference is a $1.2 billion swing. That is real money by my count.

Also seemingly relevant to the topic of effectiveness of this spready to predict inflation is a research piece put out by the Bureau of Labor Statistics in 2019: Inflation expectations and inflation realities: a comparison of the Treasury Breakeven Inflation curve and the Consumer Price Index before, during, and after the Great Recession. It concluded that TBI (Treasury Breakeven Inflation) rates reasonably approximated inflation reality before, during, and after the Great Recession of 2007-2009. It noted that the average and median deviations between TBI rates and their respective annualized CPI-U inflation rates never exceed 81 basis points, and that, moreover, the dispersion of deviations, as measured by standard deviation and range, decreased as the maturity horizon increased. It went further to speculate that given that TBI expectations overshoot actual inflation in the long term and undershoot inflation in the short term, it is likely that the liquidity premium has a considerable effect in the short term but gets more than offset by the inflation premium in the long term.

Generally on Inflation and Commercial Real Estate

What is the impact of inflation on commercial real estate? In the near term, higher inflation tends to bring higher interest rates. Higher interest rates are a negative for commercial real estate. Higher rates means larger debt service payments, reducing the buying power of purchasers, and negatively impacting deal economics. It also means makes fixed income investments a more competitive investment, likely pulling capitalization rates (cap rates) up, and thus prices down. Over a longer period, however, the prospect of inflation leads to a principal benefit of commercial property investment, that of its potential as a hedge against inflation. After all, more inflation should lead to higher rent, at least in time.

MIT published an excellent whitepaper on real estate’s ability to keep pace with inflation with data to 2016. They looked at then tendency of retail, multifamily, industrial, and office income and values to keep pace with inflation. The best at keeping pace income-wise was retail, with rent growth of 102% of inflation. Office was the worst performing at a quite dismal 18%. Values across the property types were more consistently kept pace, with retail again doing the best appreciating at 107% of inflation, office again the worst at 74% of inflation. I’ll speculate that the fairly drastic difference between income and value keeping pace with inflation is driven by vacancy. If you’re interested in the topic, read the paper.

Expectations for inflation also come into play with lease structure and due diligence. A lease structure with a fixed rent increase becomes less attractive for a landlord with higher inflation expectations. Similarly, a commercial property being acquired with existing leasing in place that have fixed or capped rent increases looks less attractive as inflation expectations increase. Also, a property being purchased with fixed rate financing will look increasingly attractive if a buyer anticipates inflation fueled increases in income. Inflation, in short, is very important to commercial property investors.

Destinations Related to this TIPS Spread Post:

- WSJ US Treasury Quotes

- WSJ US Treasury Inflation-Protected Notes

- JP Morgan: Reading Inflation Expectations from the Treasury Market

- Investopedia: The Tips Spread

- Learning Markets: Monitoring Inflation with the TIPS Spread

- US Bureau of Labor Statistics Consumer Price Index (CPI) Page

- Kansas City Fed: Can TIPS Help Identify LongTerm Inflation Expectations?