When evaluating the financials of properties there are a couple of important ratios for you to consider, and one you will likely want to know for your bank.

When evaluating the financials of properties there are a couple of important ratios for you to consider, and one you will likely want to know for your bank.

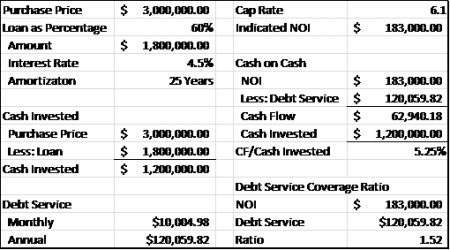

Cap Rate: The cap rate, calculated by dividing NOI (net operating income) into the price, is somewhat like an interest rate for a CD or yield on a bond. As an example, if you buy a property for $3 million and the cap rate is 6.1, it would indicate your net operating income (NOI) is $183,000 ($3,000,000 x 6.1%).

Cash on Cash Return: Although a simple concept, this one is slightly more involved. Assume we are working with this same $3 million property at a 6.1% cap rate, but that we borrow 60% of the purchase price, $1.8 million, at 4.5% interest with a 25-year amortization. In this case, you borrowed $1.8 million, thus your out of pocket investment is now $1.2 million. The payment on this mortgage would be $10,004.98 monthly, $120,059.82 per year. Cash flow would then be equal to the net operating income of $183,000 ($3 million x 6.1% given cap rate of 6.1) reduced for this $120,059,82 in annual debt service, or $62,940.18. The cash on cash return is obtained by dividing this $62,940.18 cash flow number into the $1.2 million investment, which in this case arrives at 5% ($62.940.18 / $1,200,000).

Debt Service Coverage Ratio (DSCR): Banks want to know that you are generating a surplus of cash in order to service their loan. to gauge this, among other things, they evaluate the ratio of NOI to debt service on the requested loan, generally seeking a ratio of 1.25 or better. Using this same example of a $3 million property at a 6.1% cap rate, borrowing 60% ($1.8 million) at 4.5% with a 25 year amortization, one calculates a debt service coverage ratio of 1.52, arrived at by dividing NOI of $183,000 by the debt service calculated above of $120,059.82. As long as nothing else is amiss, in normal environments most banks would likely approve this loan.

Considering

Although enticing, the cash on cash return is far from the complete story. First, with each payment, a part of debt service given some amortization goes to principal, which fattens an owners balance sheet. Thus to net this out does not give credit to this benefit. An even bigger consideration, however, comes in the form of rent growth (or decline) and change in value over time. Properties with higher cash on cash returns may score poorly in this area, while those with lower may be accompanied by more optimistic expectations.

Debt service coverage ratios, although generally discussed for loan qualification purposes, also are a useful risk metric for investors. All else being equal, if the debt service coverage ratio is higher, risk may be considered lower. There are countless stories of real estate investment success, but there are also numbers of tragic failures. Allowing some consideration of risk helps to assure one’s long-term sustainability.