In my commercial real estate brokerage business, I’ve noticed a trend of some buyers expecting lower prices on properties, sometimes even clearly taking offense at a seller not budging on price. There seems to be, with them a sense that they know better to such a degree that they are disgusted by the gall and ignorance of some seller that can’t see what they know for sure to be the case. Maybe they are right, but then I’d direct them to the stock market.

Numbers of years ago, as a financial advisor at Morgan Stanley, I recall pulling up a chart of the Venezuelan Stock Market on my Bloomberg terminal. They were going through difficult times, including a nasty devaluation of the Bolivar, their national currency. Thus, I was momentarily disoriented to see their stock market ascendant. A couple of seconds later it hit me, “duh, that’s in Bolivars.” Indeed it was. In dollars, the market was down, as one might expect, but in Bolivars, it was up, way up. I can imagine in post WWI Germany, when the price of a loaf of bread went from a few Papiermarks to hundreds of billions of them, that the stock market in local currency would have performed really well. What you can buy with the proceeds is what matters, however. It is surely more obvious at the extremes, but it always matters.

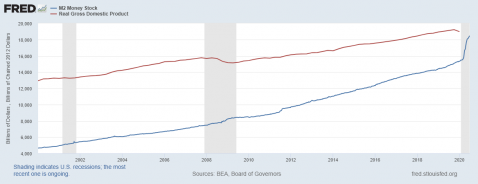

That brings me back to commercial property. The aforementioned self-professed wiser than thou buyers that claim to know that property prices should be lower will mention the printing of money as one of their indicators of impending disaster. One can indeed see the effects on money supply of the Fed’s actions in the chart of M2 embedded in this post. Actually, though, that could indicate higher prices in dollars. That is the rational case I allude to in the title of this post.

With decades enjoying a fairly stable economy, we’ve lost track of the fact that stocks are a hedge against inflation. This is the same for real estate. Imagine inflation was to indeed rear its ugly head and triple the price of goods over the coming years. With cash in the bank, you’d be able to buy a third of what you could previously. Would AT&T phone billing amounts remain at the same levels? No. They’d triple, more or less, and managed properly so would their earnings. Would rent on a building you own remain the same? No. Again, it would triple, more or less. The real rate of return on property might be more or less than it has been historically, indeed it might be lower. However, compared to cash, with inflation considered, it would in all likelihood be much better than owning cash or fixed income instruments.

Will Rogers once famously quipped that he was more interested in a return of his money than a return on his money. That advice serves one well when you one count on the value of money. Absent that, it is worth considering the definition of money, if not replacing the word “money” with the phrase “buying power.” Thus, restated, “more interested in a return of your one’s buying power than a return on one’s buying power.”

I don’t know the answer on all this. I don’t think anybody does, even the Fed Chairman. We are in uncharted waters. We’ve had recessions, we’ve had pandemics, and we’ve seen growth money supply, but to my knowledge we’ve not seen all of these together on a global basis coordinated to this degree. Strap in.

In thinking about this coronavirus situation since it first arose, however, I’ve come to realize that the variance of outcomes is wide, and that possible outcomes include some with positive returns on a nominal basis. Stated more statistically, though I recognize a recession is not good for business and thus not good for commercial property, the implied standard deviation of possible outcomes in my head has increased.

Going further with this, one could perhaps make a case for Nassim Taleb styled tail risk (black swan risk to use Taleb’s term) with regards to inflation, i.e. currency devaluation, which in turn makes a case for securing commercial property for the hedging aspects of it, as investors do with gold. Thus, the rational case for commercial real estate could be an embedded dollar put option benefit in the context of unprecedented actions by the Federal Reserve in a likewise unprecedented environment, and the associated risk of inflation. Those not budging on selling price and the buyers that are choosing to meet their price expectations may get there by accident, but they might be right. I’m not saying they’re right, but I am saying they are not clearly wrong.

Time will tell.