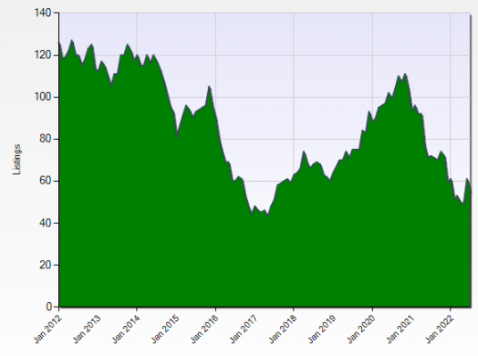

About any active commercial broker in Miami-Dade will tell you that there is all kinds of demand for industrial property, but none to buy. I can personally attest to this. This chart of properties noted as “industrial” in the Miami-Dade MLS and with an asking price of $1 to 5 million (mid-market industrial) illustrates this. The number of such active listings has only been in a trough like this one other time in the prior decade.

Further, I don’t recall the industrial property market being as tight in 2017 as it is today. Thus, I wonder about the listings that make up the data behind this chart. It could be that there are more grossly unrealistic listings today – there are always some – than there were in 2017. After all, nothing requires a listing price to be based on reality. And, of late, anecdotally at least, there seems to be an uptick in sellers and their brokers listing properties well beyond a generous price. Playing off the age-old philosophical riddle; if a property worth $1 was listed for sale in the forest for $3, was it really listed?