Finding myself involved in multifamily development deals of late, I tasked myself with updating my general feel for area construction costs of such projects. What I discovered matched all such conversations of late and can be summed in a word; escalating.

One conversation was with a principal of a substantial area general contractor. When I asked him this question, he pulled up a project they’d recently done to answer the question as $207. That seemed to be a middle of the road development, what the National Building Cost Manual would call Class 3 “High Average Quality.” He quickly added that material costs were up substantially and that he would guess this would be more like $240-270 now.

Similarly, I was discussing with a contractor a price to develop a particular multifamily project. Within the prior year that projects construction costs had been preliminarily estimated at just over $24 million. Now, due to rising costs, that number has increased to $27 million. A back of the napkin calculation, guessing at the percent that is usable, etc., arrived at a similar cost psf to construct.

Bueller? I mean, Powell? Jerome Powell? Mr. Powell?

It should be quickly noted that both of these estimates included costs for architects, etc. It is difficult to standardize these psf estimates. What I find most interesting is the estimates in the increase in the cost of construction. Development land has value based on it development gross margin, developed value less development cost. When development costs increase without an increase in developed value, development gross margin drops. This drop in turn pushes down on the value of development land.

An online source estimated construction costs 2.5 year ago for Atlanta – the factor used by National Building Cost Manual for Atlanta was about 10% higher than Miami in their 2019 manual – at 184 psf for a 4-7 story building, 220 psf for 8-24 stories in the fourth quarter of 2018. That may have been correct then, as costs have indeed risen, though it always seems to me that the real bids are higher than estimating tools say they will be. In any case, costs are higher more now. A quick note for developers from the north, the NBCM area modification factor for New York City is about 30% higher than Miami. For Boston, it is about 36% higher.

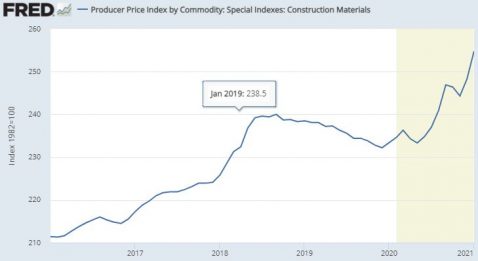

Rising constructions costs as a challenge for developers is a conversation that has been active for a while, as evidenced by the charts of construction labor and materials costs herein. Now, however, the problem seems more pronounced, with materials costs in particular surging to ever higher levels.

Bueller?