Property Types ‘Commercial/Industrial’ and ‘Land-Commercial/Business/Agricultural/Industrial’,

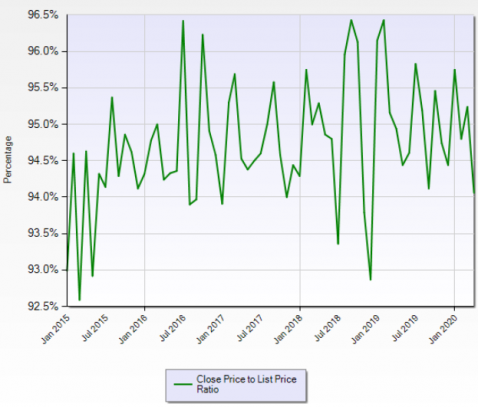

Sales to List Price Ration Calculated from 15,543 Listings

Granted, one month does not a recession make. However it is worth noting that commercial properties traded at a somewhat normal price in relation to listing price in the COVID-19 troubled month of April, as can be seen in the chart above. Sure, this ratio is lower that the prior month, but only a bit, in a way that looks like a normal fluctuation, and in any case still well above lows set in prior years. Note this is for all sales in MLS entered as improved or commercial land, dubbed ‘Commercial/Industrial’ and ‘Land-Commercial/Business/Agricultural/Industrial’ in that system. Surely much of the effect of the coronavirus pandemic is visible in reduces volume of sales, with everyone for the moment in a “deer in headlights” state. What this does represent, however, is that sellers were not dropping prices in April sufficiently for it to nudge this data. Where we go from here is the trillion dollar question.