A recurring theme of late in our commercial real estate brokerage practice is that of difficulty in finding mid-range industrial property, from 10,000 to 30,000 square feet, to purchase. Anecdotally, it has been obvious for a while that the demand for such property is notably disproportionate to the modest supply. This bears out in low vacancy rates, but that alone didn’t seem to tell the full story to what we’ve been observing, an ever tighter industrial market squeezed by population growth and related growth in commerce, the increasing allocation of land for housing and other uses generally more desirable (than industrial) to community leaders, and the gators-to-the-left-waves-to-the-right geographical constraints of South Florida.

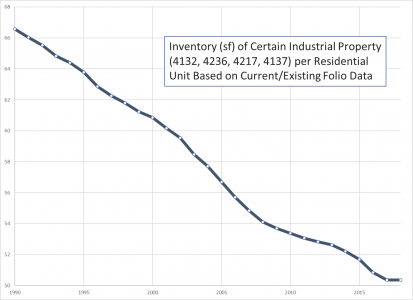

While residential units have grown with Miami’s population, some industrial type properties have lagged, resulting in less square feet of such property per residential unit.

The accompanying chart shows the total square footage in Miami-Dade county for certain types of industrial properties, those represented by a land use code of 4132, 4236, 4217, or 4137, general light manufacturing and distribution type properties, per the total number of residential living units. This isn’t perfect. For example, any properties not in service today that were in the past would not be included, as this is based on current folio data. However, this would affect the numerator aggregate industrial square footage as well as the denominator, residential units. Also, some may wish to use other types of properties as a more representative class, but this is at least a representation of some class of industrial properties. Regardless, we would believe this is fairly representative chart. Most notably, its black diamond ski slope shape matches our anecdotal experience that can be summarized with an owner’s two words, “seller’s market.”

Related Resources: