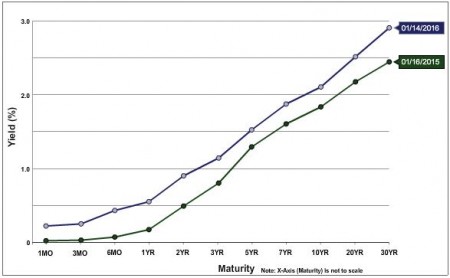

U.S. Treasury Yield Curve January 16, 2016 vs. January 14, 2015

The U.S. Treasury yield curve has shifted up slightly in the past year, as can be seen in the accompanying chart. Rates, albeit still low, are about 25 to 50 basis points higher at every maturity versus their level about a year ago.

The consensus among prognosticators of late has been that rates will edge upwards, but not significantly, and in small increments. Slowing in China, concerns about slowing growth globally, and plummeting oil prices likely further mute concern of interest rate increases in the near term,

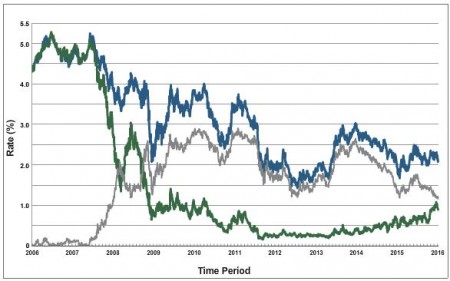

U.S. Treasury Rates 2-year and 10-year 1/3/2006 to 1/16/2016

For commercial real estate investors, this continuing low interest rate environment is a positive, as the cost of money to finance transactions remains low. This can be appreciated in the second chart, which displays rates for the 2-year (green line) and 10-year (blue line) treasuries over the prior decade. The grey line is the difference in the two.